Before our kids were born, in lieu of exchanging Christmas gifts, my husband and I decided to plan a big annual trip together. Two-ish weeks, just the two of us, every year. We started it to celebrate paying off my student loans early and to finally go on a honeymoon. It continued because of the fruit we saw from investing in some of what we value and enjoy: our marriage, food, and travel.

“Annual, multi-week trips” was an admirable long-term goal to have on the board, but now that we have kids, reality looks a bit different.

Instead of thoughtful, months-long planning for big trips away, we’ve replaced that with shorter getaways when grandparents are willing and able to hang with our boys. We realized we hadn’t been as intentional recently; so a few weeks ago, we planned a spontaneous 3-day trip to London and crammed in sightseeing, amazing meals, and a Tottenham Hotspurs soccer match. It was a blast, and it was exhausting. It also resulted in some nasty blisters from all that walking (read: I sit too much).

Travel and one-on-one time are scarcer these days. But what hasn’t changed after all these years together? Intentionality around spending on what we value most. The How is different, the Why is not.

Early in our marriage, we agreed to be thoughtful about our spending, saving, and giving. We had (and still have) many conversations about what’s most important to us, and try hard to allocate funds with those things in mind. We grow and change as people, and allocation of resources should evolve, too. We don’t always agree, but we do communicate.

As a financial planner, I believe each person, each family, should spend their most limited resources—time and money—on what they value. It’s easier to invest in something when you value what it means and brings to your life. It’s also easier to forgo something if it means achieving the dream sooner. If you’re married, you may not perfectly agree on all things with your spouse, but you only figure that out by talking about it and coming to agreement on how to move forward. Without painting the picture, it’s hard to know what you’re working towards. It’s about progress on building the path, not perfection.

Set the Vision for Your Future with Verum Partners

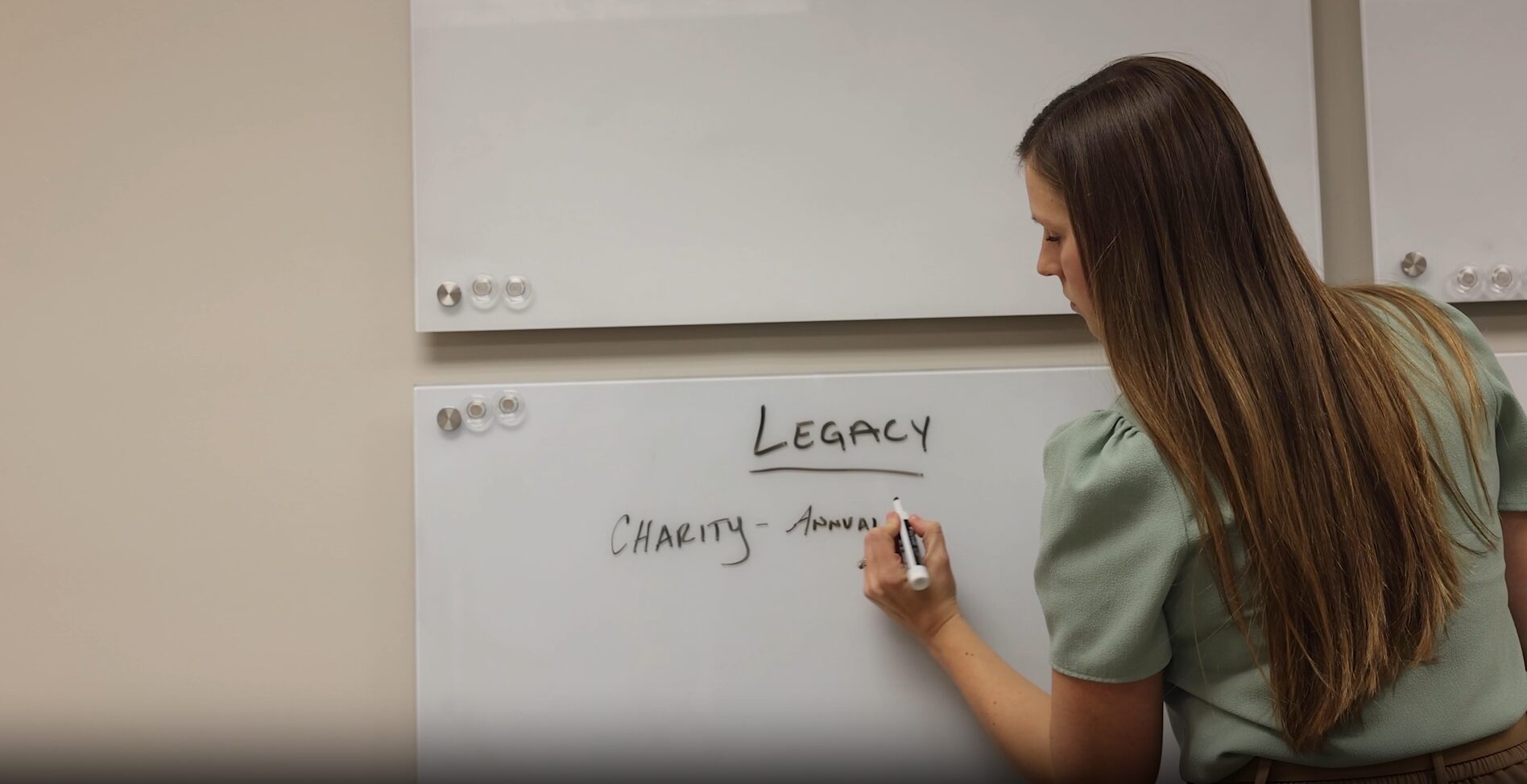

In recent years, our team realized that we could help families by facilitating these conversations. Today, Verum’s process includes a “Set the Vision” discussion with new clients. During onboarding, clients are sent on a “money date” (with a list of questions) to talk about their vision for their lives and finances, including plans for work, leisure enjoyment and goals, legacy, and concerns. We then invite them into our living room-style space and whiteboard their thoughts, talk about priorities and tradeoffs, and determine which topics to tackle first. We want to get to know our clients before we help them build their path forward, and revisit every five to ten years to ensure we’re still moving in the right direction. For long-standing clients who are willing, we’d also like to “re-Set the Vision.”

We all know money management is personal, emotional, and often comes with layers of complexity. That’s why your financial planning shouldn’t be forced inside a prefabricated box. Instead, your fingerprints, your vision, should guide the financial advice you receive. Money is still a relatively taboo topic, but in your family, it doesn’t have to be.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor. The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. For additional information, please visit: https://verumpartnership.com/disclosures/

Be the First to Know

Sign up for our newsletter to receive a curated round-up of financial news, thoughtful perspectives, and updates.

"*" indicates required fields