Today, companies big and small are utilizing equity-based compensation packages to motivate (and retain!) their top talent. This kind of compensation can align the interests of both the company and the employee in several ways, but the overall takeaway is this: high caliber employees are incentivized to remain with their company longer-term (via vesting schedules) while contributing to and participating in the growth of the company’s earnings (long-term value appreciation).

These equity- and performance-based benefits vary depending on company status (public vs. private), company size, and employee rank and tenure. Whether a component of a long-term incentive plan (LTIP) or a compensation package for a new hire, it’s important to understand what the benefits are, as each award has its own nuances, particularly around taxation.

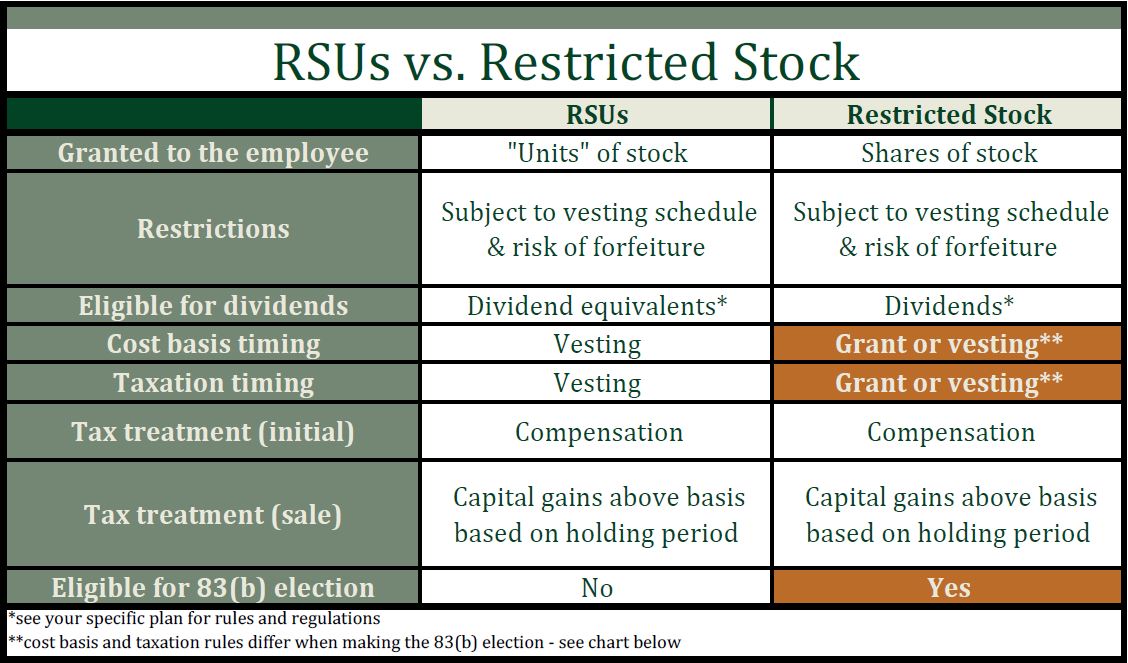

Two of the most common forms of equity-based compensation we see when building out cash flow, tax, and net worth projections are Restricted Stock Units (RSUs) and Restricted Stock. We explore some of the differences below.

Restricted Stock Units (RSUs)

Stock, in the form of “units,” is promised to be delivered to the employee at a future date, often in lieu of cash. RSUs are issued on a restricted basis, meaning you can’t sell, assign, or transfer the stock while under restriction, are subject to a vesting schedule, and can be forfeited.

- The restriction goes away upon vesting, which usually occurs in annual tranches over a period of several years (3- to 4-year terms are common).

- Upon vesting, the stock units automatically convert to “regular” shares of stock, and the value of the shares becomes compensation based on the current stock price.

- When the shares of stock are sold, the capital gain or loss will depend on the value on the day the stock vests, which determines cost basis.

Example: Bank of America issues 2,000 RSUs to Nick on June 15th, 2019. The units vest over 3 years, 1/3 per year on July 1st. On July 1, 2020, the stock price is $23 and 667 shares vest, adding $15,341 of additional compensation to Nick’s earnings for the year. Nick owes income tax on those dollars and Bank of America withholds the appropriate amount of tax automatically when the transaction occurs. His cost basis in the shares is $23/share, so if he decides to sell them at $24/share on July 10th (less than two weeks later), he’ll pay short-term capital gains tax on the $1/share increase in value.

Restricted Stock

- These awards have many of the same traits as RSUs, their “fraternal twin.” The major difference? Actual shares of stock are granted to the employee, as opposed to “units.” This opens the door for additional benefits like dividend payments and IRS Section 83(b) election eligibility. Stay with me…

- Dividends: Because actual shares of stock are granted outright, though they remain restricted and subject to a vesting schedule, recipients may be entitled to any dividend payments the company makes to shareholders based on the number of shares granted. (Note: dividend equivalents may apply to RSUs…see your specific plan for details).

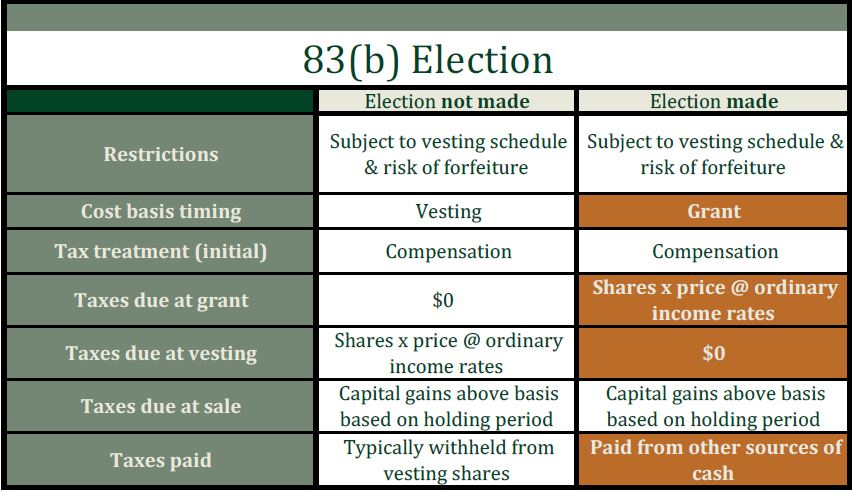

- 83(b) Election: In short, the 83(b) election changes the taxation of the restricted stock. RSUs and restricted stock are generally taxed upon vesting (as explained above), but the 83(b) election allows restricted stock to be taxed upon grant.

- This election must be made within 30 days of the grant date.

- Taxes are due upon election and cannot be withheld from the grant itself, so taxes must be paid from other sources of cash.

- Dividends: Because actual shares of stock are granted outright, though they remain restricted and subject to a vesting schedule, recipients may be entitled to any dividend payments the company makes to shareholders based on the number of shares granted. (Note: dividend equivalents may apply to RSUs…see your specific plan for details).

More details on the 83(b) election can be found here & here.

Making the 83(b) election can be a great tax opportunity but is far from risk-free.

- Cost Basis – By locking in cost basis on the grant date, any future price appreciation is subject to capital gains tax rates upon stock sale. If held for more than one year (which generally happens automatically, due to multi-year vesting schedules), the rates are highly preferential.

- Taxes – If the stock price falls, the employee risks having paid more in ordinary income taxes (at grant) than they otherwise would have. However, if the price rises, employees potentially shift ordinary income tax to capital gains tax.

- Forfeiture – If an employee makes this election on a grant but then leaves the company before the stock vests, he/she generally forfeits the unvested shares and is unable to recoup taxes paid on the lost shares (though forfeiture exceptions may apply for retirement, death, or other special circumstances…see individual plan prospectus for details).

Example: Duke Energy issues 2,000 shares of restricted stock to Katie on March 16, 2020. The shares vest over 3 years, 1/3 per year on April 8th. Katie is considering making the 83(b) election on her shares. By making this election, she will be adding roughly $151k in compensation to her earnings this year (2,000 shares issued at $75.70), instead of spreading that compensation over 3 years, and will owe taxes that must be paid from other sources of cash. The stock’s grant price, down over 30% off its 1-year high after a substantial market correction, combined with Katie’s cash flow position, tax projections, and financial goals, gives her confidence that making the election would be a good decision. While Katie is mildly concerned that she may not be with Duke Energy in 3 years, she works with her CPA to confirm the election is advisable. She files the election with the appropriate parties and carves out a piece of her cash reserves to fund the tax bill, with plans to replenish that cash over time for future planning opportunities. By making the election, Katie has the opportunity to realize future stock appreciation at capital gains rates (given current tax law) and hopes to benefit from a market recovery over several years.

Planning and strategy work should be considered each year an employee receives a new grant. The game plan can be modified from year to year and recipients are best served by a long-term strategy that weighs the pros and cons of building a concentrated stock position. Discussing and reviewing various scenarios with a financial planner or tax advisor is paramount when working with these types of company benefits.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information, and it should not be relied on as such.

Be the First to Know

Sign up for our newsletter to receive a curated round-up of financial news, thoughtful perspectives, and updates.

"*" indicates required fields