Our Evolving Views of Bitcoin

Special Disclaimer: Any allocation to Bitcoin should be considered speculative. In this paper, we make a case for why investors should not ignore Bitcoin as a potential asset class. We are not endorsing or recommending that investors own Bitcoin. Before making any allocation to Bitcoin you should do your own homework, understand what you own, and speak with a financial adviser. I currently own more than one Bitcoin and less than two Bitcoin personally. Bitcoin is highly volatile. In the few weeks that it took to research, write, edit, and post this paper the price of Bitcoin traded in an extremely wide range of $18,000 to $41,000.

Summary:

In the fall of 2015, at a conference in Charlotte, NC, I received my first lesson on Bitcoin. I had heard of Bitcoin, but I had no idea what it was. Listening to the concept of Bitcoin and blockchain I felt like I was in a foreign language class in college. I had no idea what the speakers were talking about. When I got home, I researched Bitcoin, found it to be interesting, and then put it aside. In 2017, the price of Bitcoin went through the roof. It had all the classic markers of a mania. I wrote about Bitcoin at the time and concluded while Blockchain was an interesting technology that may change the way the plumbing of the capital markets works, it was not clear to me how it correlated to the price of Bitcoin. The mania seemed concerning, the evangelists of Bitcoin were nothing short of strange, and everything about the crypto space sent my antenna up. Our conclusion was clear and straightforward: Stay away and watch what happens.

The price of Bitcoin topped out just shy of $20,000 and crashed in a brutal fashion. After multiple rebounds, the price never came close to $20,000 and crashed again in the pandemic shut down of 2020 to just north of $3,000. Since that time, the price has increased more than 11x. When we started writing this paper the price was under $18,000. At the time of finishing the paper the price is around $35,000.

As our journey to understand Bitcoin has progressed our opinions have evolved. I currently own Bitcoin personally but not enough to matter if it goes to zero. My opinion started to change after I listened to The Investors Podcast with anonymous Twitter handle Plan B in late 2019. (Plan B has been verified to be a legitimate investment professional who covers Real Estate for a large European institutional investment firm.) Plan B’s Stock-to-Flow model changed my understanding of digital scarcity. Supply and Demand drive markets, and the shrinking supply of new Bitcoin coming on the market may drive the price higher unless demand growth shrinks by a proportional amount. Here are a few summary bullets of our paper:

- Bitcoin is a peer-to-peer electronic cash system that allows people and entities to send money anonymously back and forth around the world without the need for a third-party intermediary.

- Market participants called “Miners” compete to verify transactions (they do the banks’ job) and are rewarded with newly mined Bitcoin. The reward for verifying a transaction cuts in half every four years or so (a “halving”).

- 88% of all Bitcoin have been mined since 2008 and the other 12% will slowly be mined over the next 120 years. Thus, the price has gone up dramatically during a time in which new supply coming online was vast. The new supply is slowing dramatically.

- There is a steadily growing consensus in the investment community that Bitcoin could be a store of value much like gold.

- Bitcoin is hard to value intrinsically. Unlike equities or bonds there is no cash flow or income to lay the basis for valuation. Anonymous Twitter handle Plan B turned to a method for valuing gold to attempt to model Bitcoin pricing – Stock-to-Flow. When a Stock-to-Flow model is applied to Bitcoin its price follows the model very closely. Additionally, the model carries rational economic reasoning. It is the best model I have seen to date for valuing Bitcoin. Some have noted that correlation may not be causation and thus this model could fail. It’s entirely possible. The model will be useless if the market believes Bitcoin is not a store of value.

- Other models that have been used to value Bitcoin include Total Addressable Market, Equation of Exchange, Network Effect, and Cost of Production.

- In trying to apply Bitcoin to a portfolio that has been optimized using Modern Portfolio Theory we assumed that Bitcoin had an 80% chance of losing 100% of its value but a 20% chance that the Stock-to-Flow model correctly predicts the future price of Bitcoin over the next decade. Despite the assumption of total loss 80% of the time, Bitcoin was consistently included in our optimized portfolio assumptions.

- We are not advocating that investors run out and buy a copious amount of Bitcoin. Each person needs to make their own decisions. Security, fees, ease of access, and volatility are all reasons to be wary and to proceed with caution. While the risk-reward proposition appears to be asymmetric, any asset that poses a high probability of total loss should be discounted heavily when considering a portfolio allocation.

- Bitcoin is worth paying attention to and the longer the value stays high, the more likely the value will stay high. This paradox is counterintuitive but needs to be considered since confidence in Bitcoin’s properties as a store of value will consequently increase demand.

- Ultimately, investors need to think about how to minimize regret and maximize solutions. For many, owning Bitcoin simply may not make sense. Ask yourself: How will I feel if the bullish case for Bitcoin plays out and I don’t own any? How will I feel if I own Bitcoin and it goes to zero? Balancing between these two emotions is critical. Further, ensuring that the amount you put at risk won’t change your financial future, your lifestyle, or your mental health is paramount.

What Is Bitcoin?

- In 2008, Satoshi Nakamoto (a pseudonym) published a white paper called “Bitcoin: A Peer-to-Peer Electronic Cash System.” With this paper, Bitcoin was created. Bitcoin is an open-source electronic payment system that allows, for the first time in history, transactions to be verified without a central authority governing and verifying the transaction.

- Bitcoin and the underlying technology, blockchain, solved a problem that has existed since the internet was created – scarcity. Prior to this invention, a picture posted on the internet could be replicated an infinite number of times. Thus, the internet provided no scarcity of resources and therefore a limited store of value. The Bitcoin protocol solves this issue.

- Bitcoin’s system uses third parties to verify that a transaction took place. The process uses cryptography (hence “cryptocurrency”). Rather than paying a fee to an intermediary (bank, escrow agent, custodian, etc.), one can now transact from one party to another anywhere in the world. When the transaction takes place, Bitcoin miners (originally these were computer science geeks in their basements, but now they are businesses with super computers) compete with one another to try to solve the equation. The miner that delivers the proof of work and verifies that party A transacted with party B is the winner. Miners who win the proof of work are rewarded with Bitcoins. The Bitcoins provided to the miners are new bitcoins that have been “mined” (newly issued).

- Capitalism, the open market, drives Bitcoin. There is an incentive to win the verification by receiving compensation in newly mined currency. The creator of Bitcoin brilliantly limited the number of Bitcoin to a finite number. There will only be 21 million Bitcoin ever mined. In early days, miners would win large amounts of Bitcoin when they showed proof of work. Bitcoin wasn’t worth much in U.S. dollar terms, so you need more Bitcoin as an appropriate reward. Approximately every four years, the amount of Bitcoin received for verifying a transaction is cut in half. This is called the “halving.” This limit cuts the new supply (flow) of Bitcoin coming onto the market. Bitcoin’s price has historically moved substantially higher within 12-18 months of a halving. While the final Bitcoin will not be mined until 2140, more than 18.5 million Bitcoin have been mined as of October 2020. Thus, just 2.5 million Bitcoin will come online over the next 120 years while 18.5 million came online between 2008 and 2020. Bitcoin’s finite supply makes it the first digital scarce resource.

What Is the Use Case for Bitcoin or other Cryptocurrencies?

Much ink has been spilled about the utility of Bitcoin or other cryptocurrencies. The use case for cryptocurrencies can largely be distilled into three categories:

- Store of Value: Much like gold or silver, digitally scarce assets may allow for a store of value relative to fiat currency. Because there is a finite amount of Bitcoin (much like a finite amount of gold or silver), one could argue that the primary use case for Bitcoin is to be held as a reserve for central banks, banking institutions, and corporations to protect the purchasing power of treasury relative to fiat currency (e.g., U.S. dollar, euro, pound, yuan).

- Transactional: In a future state, individuals may transact easily and seamlessly with a cryptocurrency to purchase a coffee, a car, or pay the monthly fee on their digital streaming service with a cryptocurrency. Today, Bitcoin is not a good use case for everyday transactions. This may change rapidly. Time will tell.

- Build Digital Applications: Using blockchain technology we may see cryptocurrencies play an important role in disrupting many societal transactions that we hold as commonplace today. Smart contracts that could disrupt intermediaries such as custody of investment securities, property title insurance, real estate transactions, corporate contracts, and many more items could be disrupted.

This paper will primarily focus on the first bullet, the store of value. By our estimation, Bitcoin is the likely winner to be considered “digital gold.” Its knowable final number of Bitcoin lead Bitcoin to be scarce. Other cryptocurrencies and businesses are working to figure out how to make crypto transactional and how to use blockchain and cryptocurrencies to build things. At the time of this writing, the most likely candidate to win the “Build Digital Applications” category is Ethereum. Ethereum (often referred to as “Ether”) is clearly not a finished product today and time will tell as to whether it successfully delivers the disruption that many speculate it will. Regarding the transactional category, other cryptocurrencies such as Bitcoin Cash and XRP are attempting to offer an easier transactional experience. (Note: XRP is receiving attention by the SEC as its sponsor company Ripple allegedly committed securities fraud when marketing the coin.) In this paper, we focus on Bitcoin and digital scarcity.

How Do You Value Bitcoin?

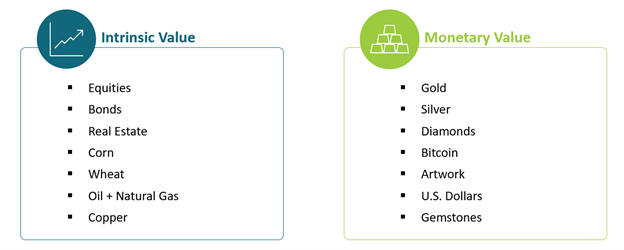

Many have tried to value Bitcoin. The range of possible values is infinite. One problem with valuing Bitcoin is that it can’t be valued through traditional intrinsic valuation methods the way stocks and bonds are valued. Bitcoin fits into the “Monetary Value” camp, similar to precious metals, fiat currencies, and fine artwork. It is possible that Bitcoin will ultimately be rendered worthless. Perhaps governments can destroy it because it is a threat. Perhaps other coins can be created, and the market will be flooded and it turns out Bitcoin isn’t actually scarce like gold or silver. Perhaps Bitcoin should be valued based on network effects based on the pool of people transacting in Bitcoin.

Source: Conway Investment Research

Source: Conway Investment Research

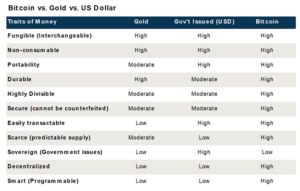

Bitcoin can most easily be compared to gold and to the U.S. dollar:

Source: VanEck & Conway Investment Research

Source: VanEck & Conway Investment Research

Given the various methods of valuation that we have witnessed and observed, we give the most credence to the Stock-to-Flow model. This model, if it ultimately holds, is unquestionably the best rationale that we have found for owning Bitcoin in your portfolio.

Anonymous Twitter account Plan B (who has been verified by multiple sources as a professional real estate investor for a European pension fund) has created a Stock-to-Flow model that has explained historical pricing of Bitcoin (R-squared = 0.99). If this model were to hold, the price of Bitcoin would roughly be between US$55,000 and $200,000 by 12/31/2021 and would be between $800,000 and $2,000,000 by 12/31/2024. These are obviously eye-popping numbers. Many factors could come into play to ensure that Bitcoin does not reach these heights. The likelihood of these prices being obtained is unknowable. One thing is sure: when valued using a Stock-to-Flow model, the price of Bitcoin should increase dramatically following each halving. Ultimately, the question is when will the model break down? Thus far, the model has been surprisingly accurate. The model ultimately predicts that Bitcoin’s total market capitalization will exceed $1 Trillion over a reasonable time following last May’s halving. The value today sits at around $450 Billion. You can read Plan B’s updated paper here: https://medium.com/@100trillionUSD/bitcoin-stock-to-flow-cross-asset-model-50d260feed12

The original paper that Plan B wrote is here: https://medium.com/@100trillionUSD/modeling-bitcoins-value-with-scarcity-91fa0fc03e25

For an alternative set of valuation methodologies please view this piece from the CFA Institute: https://www.cfainstitute.org/-/media/documents/article/rf-brief/rfbr-cryptoassets.ashx

Why Would There Be Value in Digital Scarcity vs. Gold or Silver or Real Estate or Stocks or Currency?

Valuing something that pays no income is very difficult. Some argue that Bitcoin is worthless because it doesn’t pay an income and it isn’t inherently being used for transactions or being used to build something (gold vs. steel, for instance).

However, Bitcoin’s payment system allows anyone to send money electronically and instantaneously anywhere around the world for free (or for the cost of electricity and hardware, effectively). For Americans like me, this may not seem a big deal just yet. But ask someone from Argentina who has now seen their currency devalue multiple times in their lifetimes how nice it would be to hold an asset other than Argentine pesos and send that asset back and forth to family members in another country for free. These transactions can happen anonymously which means people can get money out from under the thumb of an authoritarian dictator. With respect to Bitcoin usage, numerous emerging markets have seen huge upticks in Bitcoin transactions as citizens question whether assets denominated in their local currency might present a risk to their financial futures. We think it is likely a currency that can easily be sent electronically for nearly zero cost will serve a very specific need in the marketplace. Further, the scarcity of Bitcoin is more knowable than the scarcity of gold or silver which is still being mined. In recent years approximately 2% of gold’s current supply has been added to its stock through mining. Bitcoin’s stock-to-flow is set to exceed gold within a few years.

- Gold has managed to serve as a store of value for more than 2,000 years. Despite having little utility and paying no income, the value of gold has largely kept up with GDP per capita. Gold has some obvious pitfalls, though. It is not easy to send gold back and forth to someone. Unless you are comfortable owning an ETF or mutual fund that owns gold, you ultimately must store the metal. It’s heavy and not very easy to move.

- Real Estate has been a time-tested store of value. Real Estate is inherently scarce. Buildings depreciate and thus the scarcity is in the land. Two issues underlie the real estate “store of value” thesis. First, not all real estate is created equal and thus real estate owners may be subject to value appreciation or depreciation based on exogenous events and idiosyncratic factors. Demographic trends, living and working preferences, technological changes, geopolitical events, and natural disasters can all rapidly change the value of real estate holdings (just ask landowners and former landowners in Fukushima, Japan, Havana, Cuba, and Detroit, Michigan). Further, real estate is subject to a value tax that is extracted by local governments with the risk of tax rates changing periodically. This is not to say that Real Estate can’t be or isn’t a great investment. Our argument here is that real estate as a pure store of value has known issues.

- Equities – A significant number of stocks in the S&P 500 became publicly traded companies after 1990. Since 1980, more than 80% of all publicly traded stocks have contributed a total return of 0% to the market index with just 20% making up the remaining investment value (Source: Longview Funds). Growth companies that compound over time and buy back shares of stock are inherently good stores of wealth. However, companies (like governments) are subject to the quality of their leaders. Various principal-agency problems exist that ultimately lead to devaluation of most equities. Very few companies dominate for more than a few decades. Diversification of equity markets is the single best long-term investment we have ever found. A diversified basket of global equities provides economic growth with less risk.

- Local Currency – Fiat currency, including the U.S. dollar, is backed by the creditworthiness of its issuer. Sending fiat currency electronically is not an easy task today. If you live in the United States and your family members live in another country, you have to go through existing banking channels where banks serve as toll collectors in the form of fees. In some cases, it may actually be cheaper to get on a plane and fly the cash in a suitcase to the foreign country. Of course, that has its own issues as countries have their own rules about moving fiat cash in and out of their country. In the last 36 months we have seen numerous fiat currencies devalue rapidly and catastrophically. Most notably, the Argentine peso and the Turkish lira. Germany’s currency unwound twice in a 30-year period and the Russian ruble (at one time one of the top 3 largest currencies in the world) has had multiple unwinds. When a currency rapidly devalues, its citizens experience catastrophic inflation coupled with low to negative GDP growth. This scenario is tragic. Owners of assets that hold their value ultimately are less impacted (equities, gold, other currencies, and in some cases real estate). While the U.S. dollar has been strong relative to other fiat currencies in recent years, it should be noted that the Federal Reserve has increased the monetary stock by a considerable amount. Federal Reserve credit increased by 64%, monetary base increased by 37%, and M2 increased by 19% in calendar year 2020 (Source: Federal Reserve, Thestreet.com). As the Fed promises to keep rates low, they continue to put their “pedal to the metal” when it comes to printing new currency. Time will tell if the U.S. dollar will hold its value. We aren’t predicting a USD collapse by any stretch. But the supply of new money should lead to some sort of inflation. Thus far, inflation has shown up in the form of asset inflation such as stocks and real estate, but hasn’t shown up in CPI, largely due to deflationary forces from technological disruption.

Where Will the Money Come From to Take Bitcoin to Such High Levels?

The short answer is that Bitcoin is already at a market value of $450B without sitting in the mainstream of the capital markets system. Institutional investors such as endowments, pension funds, sovereign wealth funds and other allocators such as wealth managers and RIAs (like Verum Partners) have a very hard time allocating to Bitcoin. Many are not allowed to buy it and most everyone can’t access it at the traditional custodial platforms. There are not many good answers. Hedge funds are starting to dip their toes into the water, but it wasn’t until this year that famous hedge funds managers such as Paul Tudor Jones and Stan Druckenmiller each blessed the idea of owning Bitcoin.

A thought experiment: What if we could time travel to 2012, and in 2012 you were told the 2020 market cap of Apple, Amazon, Facebook, Google, Microsoft, and Netflix and you asked, “where would the money come from to get to those market cap levels?” Today we know the answer. To use famous venture capitalist Marc Andreessen’s quote – “Software is eating the world.” Michael Saylor, the CEO of MicroStrategy who recently put his company’s cash into Bitcoin, made the point that the primary trend of the last few decades has been the dematerialization of things and information. (Yes, Michael is both conflicted and biased as are most people telling you about Bitcoin.) For instance:

- Facebook dematerialized socialization and thoughts.

- Apple dematerialized hardware – phones, computers, calculators, cameras, maps, health monitors, sound machines, CDs, books, etc.

- Google dematerialized information – Gone are the days of encyclopedias. Information has been democratized and Google is the toll booth operator for distribution of the information.

- Amazon dematerialized the store front – They moved shopping malls, strip centers, and retail in general from the physical to the phone/tablet/computer.

- Netflix dematerialized the distribution of media – First it was DVDs, then it was rental stores in general, and then it was the cable box, and now it’s all content.

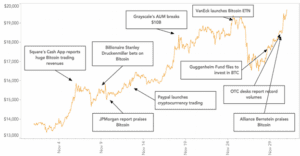

Similarly, there is a logical argument to be made that Bitcoin could dematerialize money. By this, we mean that Bitcoin and the blockchain technology may disintermediate the financial services firms that act as toll operators and middlemen. Certain banking such as custodial banking or money transactions may be disintermediated due to the blockchain. We could even see a day in which the ETF, mutual fund, and collective fund businesses are disrupted due to blockchain (meaning custody may allow investors to own slivers of the collective underlying investments instead of pooling money into shares of a fund). Institutional demand is growing, as the chart below illustrates, covering the month of November 2020 alone:

Source: Kaiko, Coinbase, Conway IR

Source: Kaiko, Coinbase, Conway IR

What Are the Major Constraints for Bitcoin?

- Difficult to Access – One major constraint to owning Bitcoin is security. Traditional banks and custodians are unwilling to hold Bitcoin on their established custodian platforms. Governments have not blessed Bitcoin as a security and there are no requirements such as Know Your Customer (KYC) or Anti-Money Laundering (AML). These constraints limit institutional investors and financial advisory firms (such as Verum Partners) from allocating on behalf of their clients. Multiple regulatory entities, including the Federal Reserve, International Monetary Fund, and other financial regulators have either proposed or hinted at future regulation that would allow for the institutionalization of Bitcoin ownership. This would likely include clarification on tax treatment, allowing for open-end mutual funds and ETFs to own them, and allow for traditional financial services firms to assist customers in holding the assets. We suspect that these changes would potentially hurt the “cause” of many Bitcoin evangelists who believe Bitcoin will disintermediate Wall Street banks; but they also would provide a green light for broad adoption of Bitcoin and other crypto assets as asset classes in institutional portfolios. These changes could provide huge upside in the price of Bitcoin and could lower volatility and lower future returns.

- Risks of Theft and Mistakes – Bitcoin transactions are non-reversible. This is by design. To create a new financial plumbing system, it was important that Bitcoin couldn’t be changed or reversed. The decentralization and lack of governing authority of Bitcoin is a feature, not a bug. However, this feature means that hackers, thieves, and transactional mistakes are undoable. If your Bitcoin is stolen, you likely won’t get it back. Over time, this constraint will likely be solved through administration, banking, and insurance services.

- Limitations to the Network – While we don’t pretend to comprehend all there is to know about blockchain and crypto, our understanding is there are limitations to Bitcoin’s network. Time will tell how this plays out. Blockchain technology advancements are happening at warp speed, but it is unclear to us whether Bitcoin will be a winner in terms of transaction volume and speed relative to other crypto.

- Principal-Agent Problem – As fiduciaries, there are broad questions as to whether an allocation to Bitcoin in a discretionary portfolio would be a violation of a fiduciary standard of care for institutions and wealth managers. Early adopters in both the money management and wealth management industries are just now appearing. Further, career risk in financial services may lead investment managers to hold off on allocating because of risk of losing their jobs if they allocate and performance is poor.

Does Bitcoin Fit Within an Optimized Portfolio?

We set out to model Bitcoin within the constructs of a portfolio. When we conducted this analysis the price of Bitcoin was $18,000 (the price rapidly escalated to $41,000 in just a few weeks then fell back somewhat). Rather than using historical returns and risk (since 2013 the annual return has been ~200% and risk has been ~95%), we created a probability weighted expected return framework. We made the following assumptions (in an attempt to be conservative):

- We assumed an 80% chance that Bitcoin will cease to exist within 10 years

- We assumed a 10% chance that the stock-to-flow implied price estimate is correct for the May 2020 halving, but the price will stay at those levels for the next 10 years ($100,000 in 10 years)

- We assumed a 10% chance that both this halving and the 2024 halving implied price estimates are correct and in 10 years the price is $1,000,000

- We assumed that risk (volatility) would stay very high but will come down as prices go up. Thus, our expected return and risk are an 18.9% annualized return for 10 years with annualized standard deviation of 78.8%

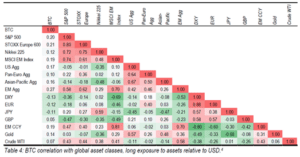

- We utilized historical correlation metrics as seen in the chart below. Note that we believe standard deviation will go down and correlations to traditional asset classes will go up if the bullish case for Bitcoin becomes a reality:

Source: Galaxy Digital Research

Source: Galaxy Digital Research

- When these expected returns and risk are applied to our portfolio construction framework, and optimized using a mean variance analysis, our efficient frontier includes a Bitcoin weight in all portfolios with a standard deviation above 3%. When unconstrained, the Bitcoin weight reached as high as 9% of a total portfolio in an aggressive, 12% volatility portfolio.

- These results considered allocating to many broad asset classes in a highly diversified portfolio. Nevertheless, our optimization was run on an unconstrained basis and thus the portfolio looked unconventional (to say the least).

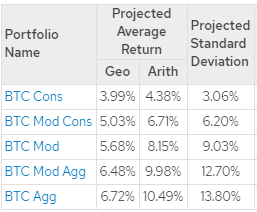

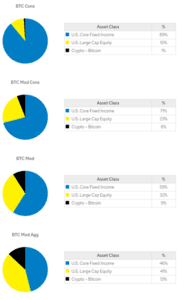

- We then re-ran the analysis and used just three asset classes – S&P 500, Barclays U.S. Aggregate Bond Index, and Bitcoin. Here are the results:

Source: Verum Partners; MoneyGuidePro; abbreviations represent Conservative, Moderately Conservative, Moderate, Moderately Aggressive, and Aggressive

Source: Verum Partners; MoneyGuidePro; abbreviations represent Conservative, Moderately Conservative, Moderate, Moderately Aggressive, and Aggressive

Source: Verum Partners; MoneyGuidePro

Source: Verum Partners; MoneyGuidePro

- We DO NOT BELIEVE that an investor should hold a large amount of Bitcoin in their portfolio. The numbers illustrated in our models are too high based on our view. The risk of impairing 6%-15% of total wealth is hard to come back from. We are simply stating our portfolio framework suggests that owning some Bitcoin may be a good bet, even if you think there is an 80% chance that it will see its demise in the next 10 years. If the probability of Bitcoin’s demise is 50% over the next few years, the expected returns would go up sharply.

- We have no way of knowing what will happen with Bitcoin. When making uncertain investments, we like to think about regret minimization to help us in making decisions. The question investors should ask themselves is, what is the risk that they do not own it and it goes to $1 million? What would that mean for other asset prices? What does this mean for the U.S. dollar? What does this mean for exposures to stocks tied to fiat currencies that could depreciate dramatically? How much regret will investors have if they do not participate and how will they get in at other prices such as $100,000 or $1,000,000?

- We would view a small allocation (1% of liquid net worth) of Bitcoin the same way we would view an allocation to term life insurance or disability income insurance or property & casualty insurance. Bitcoin could serve as portfolio insurance against a devaluing of the U.S. dollar or devaluing of incumbent financial service business models such as banks.

Given the sudden rise in Bitcoin recently we would argue that expected returns have come down to a certain degree. As prices rise, we think the chance of Bitcoin ultimately going to zero reduces significantly, but the asymmetric upside opportunities diminish. Nevertheless, the math is still compelling and likely warrants a small – potentially very small – allocation.

How Can I Buy Bitcoin?

- Speak with your financial adviser about ways you can buy Bitcoin. The following bullets are not an exhaustive list but a summary of our findings. We are not endorsing buying Bitcoin, nor are we counseling that any of the methods below are advisable:

- Directly through a financial service in a “wallet”

- Paypal and Square have each rolled out the ability to purchase limited amounts of Bitcoin.

- Coinbase recently filed for an IPO. Coinbase likely has the largest custody business for retail buyers of crypto.

- Fidelity just rolled out a Fidelity Digital Assets business to custody Bitcoin; but they have large minimums.

- Gemini is another custody offering we have been made aware of.

- Kingdom Trust is a custodian firm that is offering solutions for retail investors.

- Tradable Fund

- Multiple fund structures exist on custodian platforms. Thus far, the fees are very high, and the funds can trade like a closed end fund meaning they trade at premiums or discounts. Two notable funds trade at more than a 30% premium today which means investors are paying a high price for the ease of access.

- Currently, the IRS treatment of Bitcoin has made it difficult for fund providers to create an ETF or open-end mutual fund. We suspect one day this will happen; but if it does, make sure to understand the taxation of the vehicle.

- Private Funds

- Multiple private funds that are in hedge fund-like structures have come to market. We have reviewed most of the Bitcoin access funds in the market. Because these are private placement funds, we will not disclose the names in this forum. Private funds may be a compelling opportunity for certain investors who want more security and insurance than they receive from owning Bitcoin directly but don’t have enough money to put to work in order to receive institutional custodian-level treatment at the large custody firms. As with all things, the devil may be in the details and we urge any investor to do their research, understand the fees they are paying, and understand the security they are receiving.

- Publicly Traded Stocks

- Just as investors buy gold mining stocks to get indirect exposure to gold, there are some publicly traded companies that are either heavily tied to crypto currencies, own Bitcoin in their corporate coffers, or have direct ties to the crypto business. There are obvious idiosyncratic risks to gaining exposure this way. Further, there are risks that the market overvalues such stocks purely because of their exposure to crypto.

- Directly through a financial service in a “wallet”

Resources to learn more about Bitcoin:

- Original Paper: Bitcoin: A Peer-to-Peer Electronic Cash System: https://bitcoin.org/bitcoin.pdf

- The Investors Podcast: Bitcoin Fundamentals: https://www.theinvestorspodcast.com/bitcoin-fundamentals/

- Invest Like the Best Podcast: Hash Power: https://investorfieldguide.com/hashpower/

- Stock-to-Flow Paper: Modeling Bitcoin Value with Scarcity: https://medium.com/@100trillionUSD/modeling-bitcoins-value-with-scarcity-91fa0fc03e25

- Updated Stock-to-Flow Paper: Bitcoin Stock-to-Flow Cross Asset Model: https://medium.com/@100trillionUSD/bitcoin-stock-to-flow-cross-asset-model-50d260feed12

- Michael Saylor’s MicroStrategy Bitcoin Bet: Bitcoin: https://www.microstrategy.com/en/bitcoin

- Fidelity Digital Assets: Blog: https://www.fidelitydigitalassets.com/blog

- Animal Spirits Podcast: Talk Your Book: Investing in Bitcoin: https://awealthofcommonsense.com/2020/11/talk-your-book-investing-in-bitcoin/

- Animal Spirits Podcast: Animal Spirits: Is Bitcoin the New Gold? https://awealthofcommonsense.com/2020/11/animal-spirits-is-bitcoin-the-new-gold/

- CFA Institute White Paper: Cryptoasssets: The Guide to Bitcoin, Blockchain, and Cryptocurrency for Investment Professionals: https://www.cfainstitute.org/-/media/documents/article/rf-brief/rfbr-cryptoassets.ashx

- Research Affiliates (Bear Case): Bitcoin: Magic Internet Money https://www.researchaffiliates.com/en_us/publications/articles/820-bitcoin-magic-internet-money.html

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor. The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. For additional information, please visit: https://verumpartnership.com/disclosures/

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information, and it should not be relied on as such.