Global stocks have grabbed headlines as they experienced a fairly significant drawdown over the last week and appear to be continuing their decline this week. The S&P 500 is moving closer to correction territory (down 10% from the most recent all-time high) and the NASDAQ closing in on a bear market (20% down). The move down in equities has been fast paced and seems to be driven by a few macro events, mainly the potential U.S. economic slowdown and unwinding of the Japanese yen carry trade.

The purpose of this commentary is to provide a quick update on the current situation.

U.S. Economics:

- Last week, the U.S. received a number of economic reports that came in showing much weaker numbers than expected. This spiked investors’ fear that the Fed has waited too long to begin cutting rates.

- The Fed concluded their most recent meeting on Wednesday. They decided to keep rates steady, but their rhetoric seemed to open the door for a rate cut at the next meeting in September.

- Thursday’s market response was the first trading day in years in which market action was consistent with recessionary, rather than inflationary, concerns. This theme continued to build on Friday as the jobs report showed a further slowdown in employment for the third straight month.

- The jobs report showed 114k jobs added last month, which came in well below expectations of 175k and the 12-month average of 215k. At the same time, the unemployment rate rose to 4.3% from 4.1% the previous month, a sharp increase from the 3.7% rate where we started the year.

The report sparked the initial move out of equities in favor of less risky assets like U.S. Treasuries, driving the 10-year yield down over 40bps on the week. This was a positive signal for bonds and a great reminder of the benefits of diversification, as the U.S. aggregate bond index finished the week up 2.4%.

Last week’s economic events coincided with a rapid appreciation of the Japanese yen. On the same day the Fed decided to keep rates steady, the Bank of Japan pivoted in the opposite direction of most central banks by raising rates by 0.25%. This is only the second time the BOJ has raised rates since 2007, where they have effectively had negative interest rates since that time. For years now, hedge funds and other institutional investors have taken advantage of these ultra-low rates by borrowing against the yen to make leveraged bets on higher yielding investments elsewhere, in what has been known as the Japanese carry trade.

What is the carry trade?

- The carry trade has been popular for many years, as investors could borrow the yen at low rates, then convert the yen to U.S. dollars or other currencies to get nearly free margin borrowing and subsequently invest at higher rates.

- Theoretically, a trade like this shouldn’t be possible. However, the divergence between rapidly rising rates in the U.S. and other countries relative to Japan’s negative-to-zero interest rate policy created an opportunity to borrow in a low-rate jurisdiction and lend into a higher-rate jurisdiction. So long as the yen stayed flat or depreciated and the U.S. dollar stayed flat or appreciated, the trade was successful by creating “positive carry.”

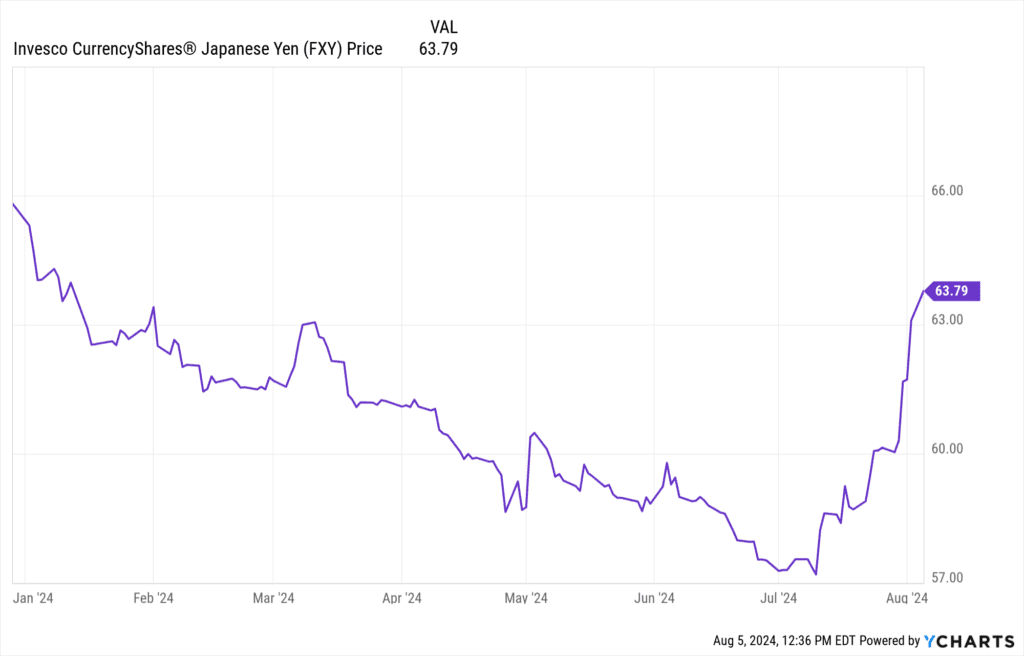

- The risk to the carry trade is that the yen appreciates meaningfully relative to the dollar, which results in higher debt repayment costs, forcing investors to liquidate their investments. The BOJ’s decision to raise rates, coupled with the weakening economic data in the U.S. and market expectations that U.S. rates are dropping, resulted in a weaker dollar relative to the yen, forcing an unwind of the trade.

- The risk of such an unwind comes when investors are forced to sell their equities and other investments to cover their margin call, which ultimately leads to an even greater appreciation of the yen relative to the dollar, further exacerbating the issue.

- These types of hidden leverage trades have been the typical catalyst for many of the previous global equity market selloffs.

Current market conditions

- The US equity markets last week finished the week in negative territory after the selloff on Friday, with the S&P 500 being down 2% on the week and the NASDAQ down 3.3%.

- When the Japanese markets opened this week, the yen carry trade really began to unwind as the Nikkei Stock Average had its worst day since 1987, falling 12.4%.

- In a span of less than four weeks, the Nikkei index has fallen more than 25% after hitting an all-time high on July 11. Over the same period, the yen has strengthened to trade around 142 to the dollar, compared with about 161 to the dollar in early July.

- This has spread some fear across the globe as equity markets in nearly every country are down to start the week.

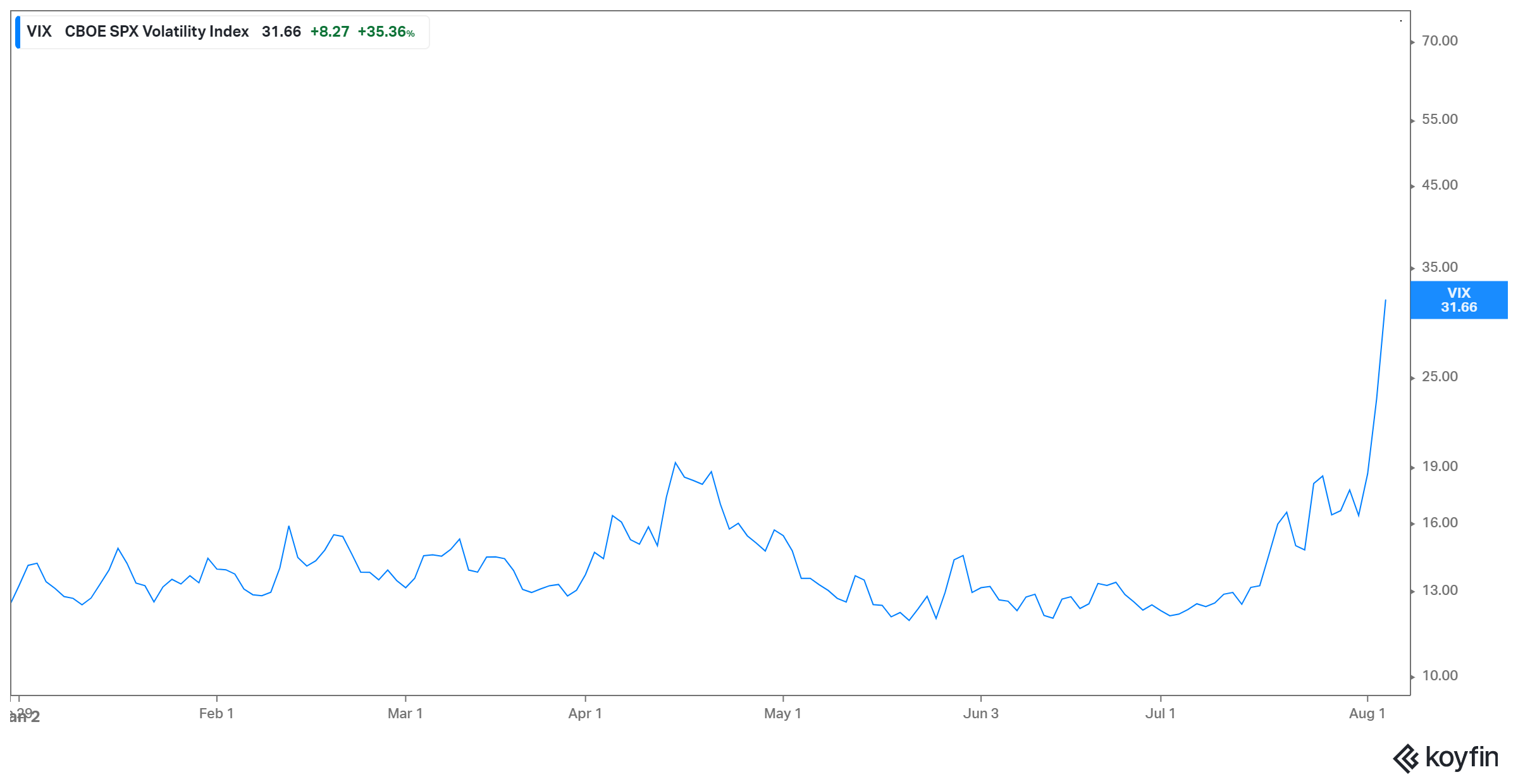

- The US is continuing its drawdown, with the S&P 500 now approaching correction territory and the volatility index seeing a massive spike from its previously muted level.

Taking a step back to view the year thus far, most portfolios are up on the year, and economic data are still positive, just weakening. Markets have done well; economic data continues to look compelling; apart from several individual companies, the stock market appears to be reasonably valued; and interest rates are providing a positive real yield.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor. The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. For additional information, please visit: https://verumpartnership.com/disclosures/

Be the First to Know

Sign up for our newsletter to receive a curated round-up of financial news, thoughtful perspectives, and updates.

"*" indicates required fields