2024 was a wild year for bar talk—especially if you were into politics and taxes. Yes, taxes! It seems like we spent the entire year reading, listening to, and speculating what the next tax policy may look like based on who was or was not going to be in office. The only thing we knew with confidence was 2025 tax policy would look identical to 2024, with only inflation adjustments being made to various thresholds. To that extent, planning for 2025 was fairly easy. All the chatter is around 2026, as the 2017 Tax Cuts and Jobs Act (TCJA) is set to expire at year-end, and we know tax policy will sunset back to the Obama-era rules, an automatic reversion.

Looking Ahead to 2026: The End of the TCJA

With clarity around where power lies in Washington, however slim some voting margins may be, we know there is the appetite to extend the themes of the TCJA tax policy in some form or fashion. Will it look identical to the current rules? Probably not, but it’s likely to be more similar than not. Why might some things look different? Congress will no doubt slip new ideas in and out of policy as negotiations progress throughout the year. This tax policy is also historically taxpayer-friendly, which means budgetary considerations will ensue.

If government budgeting worked like family budgeting and you’ve got a lot of expensive debt hanging out there, you either need to raise your revenue (higher taxes) or cut your expenses (less spending). Time will tell where these policy negotiations go.

So, what are the big things we’re watching?

Key Tax Changes to Watch

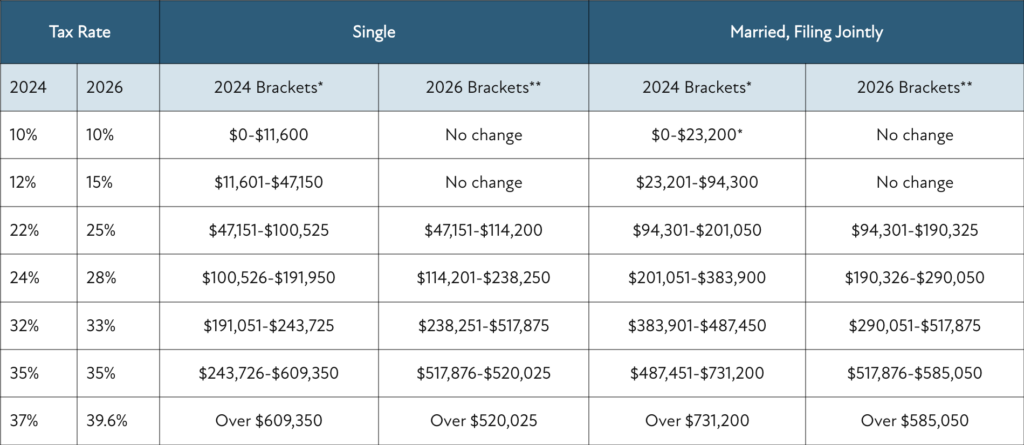

Individual Tax Rates are not meaningfully different in the first three tax brackets under either policy but do start to deviate more substantially in the bottom four (higher) tax brackets:

Estate Tax Exemption amounts are the most substantial potential change, although the estate tax in general doesn’t affect many families. Under current tax policy, each individual has $13,990,000 worth of estate tax exemption (a married couple has $27,980,000) before their estate would be subject to the 40% estate tax rate. In 2026, should the TCJA truly sunset, this amount will be cut in half to roughly $7 million per person ($14 million for a married couple). Note: It is only the wealth in excess of these estate exemption amounts that gets taxed at the 40% rate. While this is still a lot of wealth, it certainly introduces uncertainty for another large group of families.

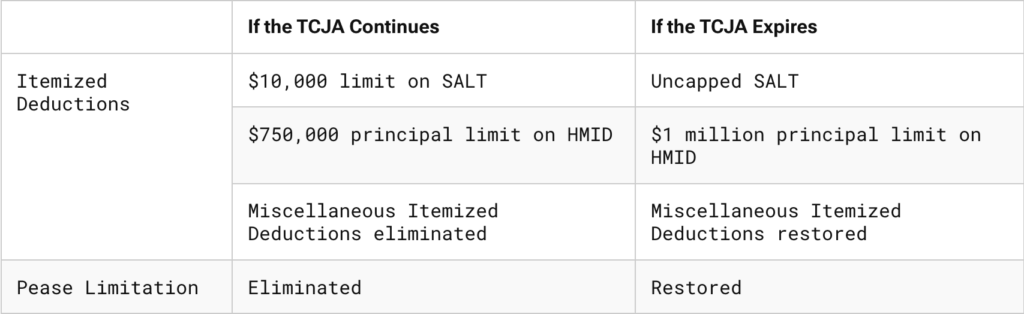

Standard Deduction is the free deduction almost every taxpayer can take against their income to help reduce taxable income. For most taxpayers, you take your standard deduction or the sum of your itemized deductions, whichever is greater. As we transitioned from the Obama-era tax policy to the TCJA, we saw the standard deduction almost double, while simultaneously we saw a more restrictive stance on itemized deductions, namely in the form of deductible state and local taxes (SALT), home mortgage interest deduction (HMID), charitable deductions, and miscellaneous and personal casualty/theft deductions. Upon potential sunset, the standard deduction will get cut back by almost 50% while the restrictions on itemized deductions will be lifted. But we welcome back Pease Limitations—essentially means-testing your itemized deductions: the higher your income, the more these itemized deductions get hair cut.

Personal Exemptions were eliminated in the TCJA but will be restored if policy sunsets. These were deductions available at the family level for the taxpayer(s) and their dependents. Child Tax Credits are also expected to be a large negotiation piece. Both personal exemptions and child tax credits are subject to reduction in availability at higher income levels.

Business Tax Provisions at Risk

The Qualified Business Income (QBI) Deduction was introduced in 2018 to provide greater fairness to businesses organized as “pass-throughs,” such as partnerships, LLCs, and “S” corporations, because the rates for “C” corporations had been reduced from 35% to 21%. If this provision is allowed to sunset while corporate rates remain lower, it brings back the fairness discussion for small businesses and may encourage more businesses to change structure to “C” corporations.

There may be pressure to restore Other Business Provisions like Bonus Depreciation, which has dropped from 100% in pre-2018 law to 40% for 2025. Expenses for Research & Development that previously were 100% deductible in the year incurred must now be amortized over 5 years, and there may be a push to restore the previous rule.

This recap is intended to cover the landscape moving forward for personal income taxes and is not intended to get into every detail around all possible outcomes, much less all the changes related to businesses.

What’s Next?

We truly do not know where tax policy will go or how quickly it will be addressed. We do understand it to be a top priority of incoming administration, but it is shaping up to be another year full of conversation around what could potentially happen. As always, we try to plan for policy changes in consideration of our client’s overall situation, balancing both the present and future.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor. The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. For additional information, please visit: https://verumpartnership.com/disclosures/

Be the First to Know

Sign up for our newsletter to receive a curated round-up of financial news, thoughtful perspectives, and updates.

"*" indicates required fields