Charitable giving is of great importance to many. Implementing tax planning strategies for the charitably inclined can help optimize giving, so more dollars can go to meaningful causes instead of the IRS.

Four tax-efficient charitable giving strategies to consider are (1) bunching deductions, (2) donating appreciated securities, (3) utilizing Qualified Charitable Distributions, and (4) forming a charitable trust.

Bunching/Donor-Advised Funds

The Tax Cuts and Jobs Act made the need to plan around charitable giving more important than ever with the doubling of the standard deduction. For 2022, the standard deduction is $25,900 for married couples filing jointly and $12,950 for single filers. Now, it’s harder to break the standard deduction threshold in order to utilize common itemized deductions like mortgage interest, state/local and property tax (capped at $10,000), and charitable giving. With the relative devaluing of charitable giving, consider charitable bunching.

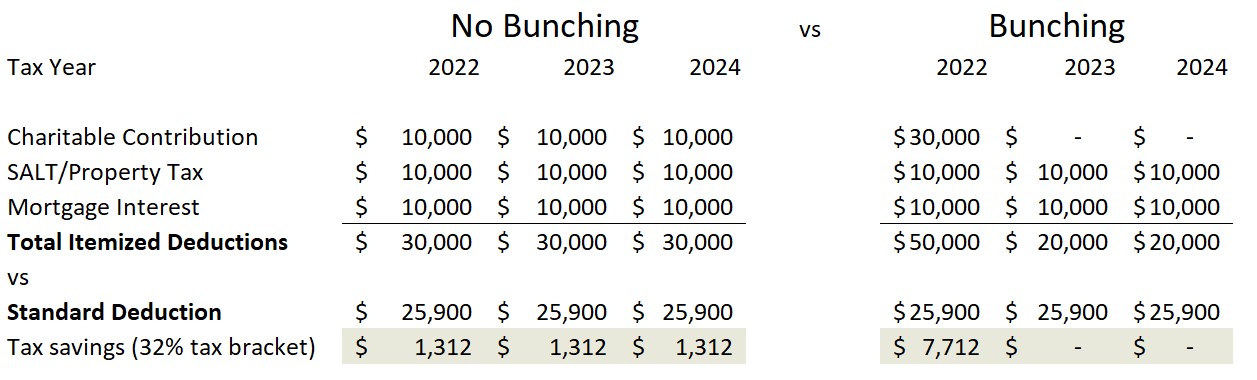

Charitable bunching entails making several years’ worth of donations at once, allowing the standard deduction hurdle to be cleared in the years you bunch, then taking the standard deduction in the years you don’t bunch. Follow the example below to see potential tax savings utilizing this strategy for someone who donates $10,000 each year compared to someone who bunches $30,000 into one year with no giving in the remaining 2 years:

Source: Verum Partners

By bundling three years worth of charitable donations at once, the tax savings over those three years amounts to $7,712 vs $3,936 if you just gave the $10k each year. You might ask, “What if I don’t want to give a lump sum to a charity, but want to spread out my giving more evenly throughout those three years?” A Donor Advised Fund (“DAF”) is your solution.

A DAF allows you to take a tax deduction in the year you contribute to the DAF, while offering flexibility to make grants from the DAF when and to whom you want. Think of it like an investment account specific to charitable giving. Contributions are irrevocable, can be invested among a variety of different securities, and grow tax-free. Then, you make grants to support qualified public charities or private operating foundations. Utilizing bunching together with a DAF are strategies that mesh quite well.

Donating Appreciated Securities

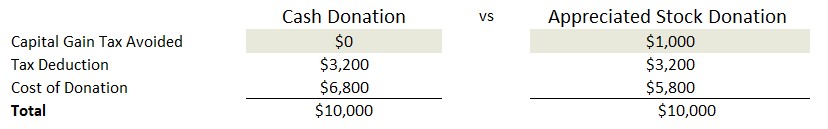

Cash can be an expensive asset to donate. Instead, consider donating appreciated securities. The donor of appreciated assets held for at least one year can deduct the full fair market value of the donation while avoiding capital gains tax on the appreciation of the asset. See the diagram below that compares a $10,000 cash donation to a $10,000 stock donation. We assume a cost basis (the price you paid for the securities) of $5,000 and a taxpayer in the 32% federal income tax bracket and 20% capital gains tax bracket.

Source: Verum Partners

Source: Verum Partners

It is important to note there are annual limits that apply to charitable deductions. The charitable income tax deduction in any given year from donating appreciated securities held more than one year is limited to 30% of Adjusted Gross Income (AGI). However, the IRS allows a 5-year carryforward of your charitable deduction that exceeds that AGI threshold.

Qualified Charitable Distributions

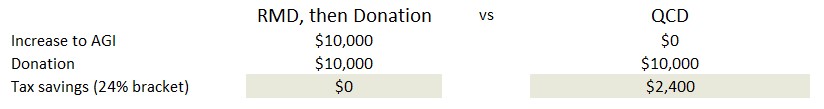

Another way to donate tax-efficiently is through a Qualified Charitable Distribution (“QCD”). A QCD is a transfer from your IRA to charity and is available to those age 70½ and older. QCDs are utilized to minimize your Required Minimum Distributions required for IRAs. Once you turn 72, you must take an RMD every year which is taxable at ordinary income rates. QCDs of up to $100,000 will be counted towards that RMD, dramatically lessening your tax burden. For those using the standard deduction, a normal withdrawal from an IRA subsequently used to donate to charity would not avoid the taxable ordinary income that a QCD would. See the example below comparing a $10,000 QCD versus taking the RMD, then donating to charity if not itemizing deductions.

Source: Verum Partners

Source: Verum Partners

Another benefit of keeping AGI lower through a QCD is that it can help avoid the Income-Related Monthly Adjustment Amount (IRMAA), which is an increase to Medicare premiums. A lower AGI also helps with the deductibility of certain types of expenses, such as medical, that are tested against your AGI.

Charitable Trusts

A more complex method of giving, split interest trusts such as Charitable Lead Trusts (CLTs) and Charitable Remainder Trusts (CRTs), can reduce taxes while benefiting both charitable and non-charitable beneficiaries.

A CLT is an irrevocable trust that makes payments to charity for a set term or for life, with the remaining trust assets distributed to non-charitable beneficiaries – usually family members. Tax benefits of a CLT (although not tax-exempt) can include an income tax deduction to either the grantor (based on value of the charitable lead interest) or the trust itself. A CLT may also remove assets from the estate of the grantor. In a low interest-rate environment, assets are more likely to grow above the IRS mandated interest rate (referred to as the IRC §7520 rate) over time, which can result in more assets passing to beneficiaries at the end of the term without being considered a gift for Gift Tax purposes.

A CRT is the mirror image of a CLT. It provides a stream of income to beneficiaries each year for a set term or for life, with the remaining balance paid to charitable beneficiaries at the end of the term. A CRT provides a charitable deduction upon funding based on the value of the remainder interest and removes the assets from the estate. Another key benefit of the CRT is its tax-exempt status under IRC §664. Because of its tax-exempt status, a CRT can be a good option to donate low-basis, highly appreciated assets to minimize income tax on the subsequent sale of those assets.

Conclusion

If you have charitable intent, make your donations the most tax-efficient they can be by utilizing these four strategies. Work with a financial planner to help effectively implement the strategies that would be most beneficial to your situation.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor. The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. For additional information, please visit: https://verumpartnership.com/disclosures/

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information, and it should not be relied on as such.

Be the First to Know

Sign up for our newsletter to receive a curated round-up of financial news, thoughtful perspectives, and updates.

"*" indicates required fields

Source: Verum Partners

Source: Verum Partners Source: Verum Partners

Source: Verum Partners