What should I be doing with cash making 5%?

With short-term interest rates at 5%, many clients are asking whether cash exposure should be increased, i.e., “why take the risk of stocks when I can get 5% on cash?” It is a compelling thought, and one which you’ve likely seen referenced in major publications recently.

While we do not know the path of rates from here, we suggest doing two things.

First, check the interest rate on your cash holdings. Emergency funds cash set-asides should be earning at least 4-5% right now; if that is not what you are seeing, we are happy to share ideas with you.

Second, we believe diversified investors who have an intermediate- to long-term time horizon will be rewarded by extending the duration of bonds in their portfolio to an intermediate posture, rather than holding 100% in cash. Why?

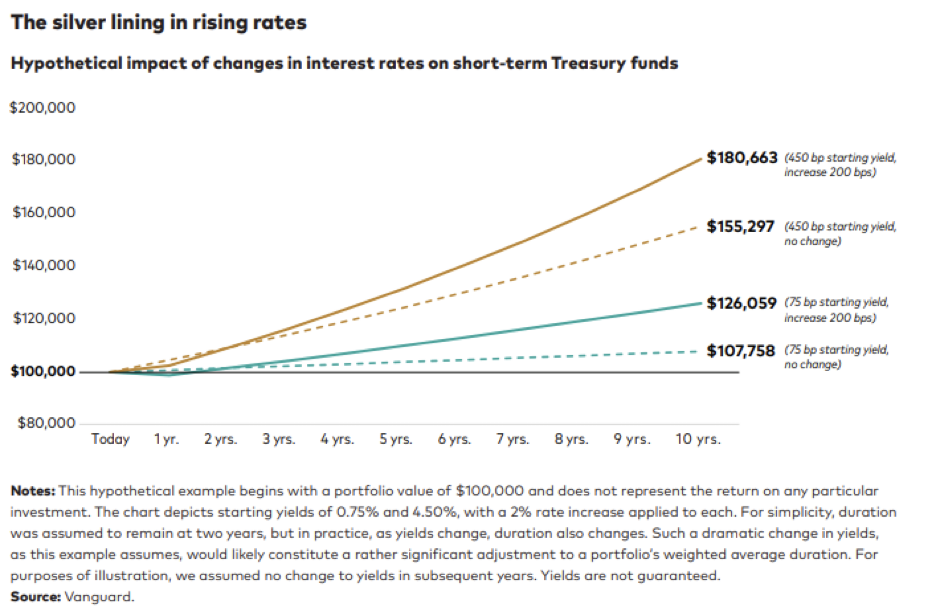

- Investors are locking in a total return equal to the starting yield of the bond fund, so long as the investment is held for long enough. A rule of thumb for “long enough” was created by bond legend Marty Liebowitz in his 2014 duration targeting paper in the Financial Analysts Journal. The starting yield will typically be similar to the investor’s total return, as long as the investor holds for a time equal to the bond duration of the portfolio plus one additional year.

- If rates go down, the bonds will see meaningful upside total return; and if that happens it may coincide with economic softness and an opportunity to rebalance into an equity drawdown.

Verum’s Investment Committee closely monitors the changing interest rate environment, which has experienced significant increases over the past year. With the Federal Reserve currently adopting a ‘higher for longer’ rate outlook and long-term yields rising, the committee feels that it is wise to extend our overall portfolio duration to lock in these higher yields, while still maintaining little credit risk. To achieve this in a prudent manner we believe in making gradual shifts from a primarily short-term bond exposure into intermediate and longer-term U.S. Treasuries. This slow-and-steady approach allows for the flexibility to continually increase duration if rates rise further, while also still capitalizing on the attractive yield currently provided at the short end of the curve.

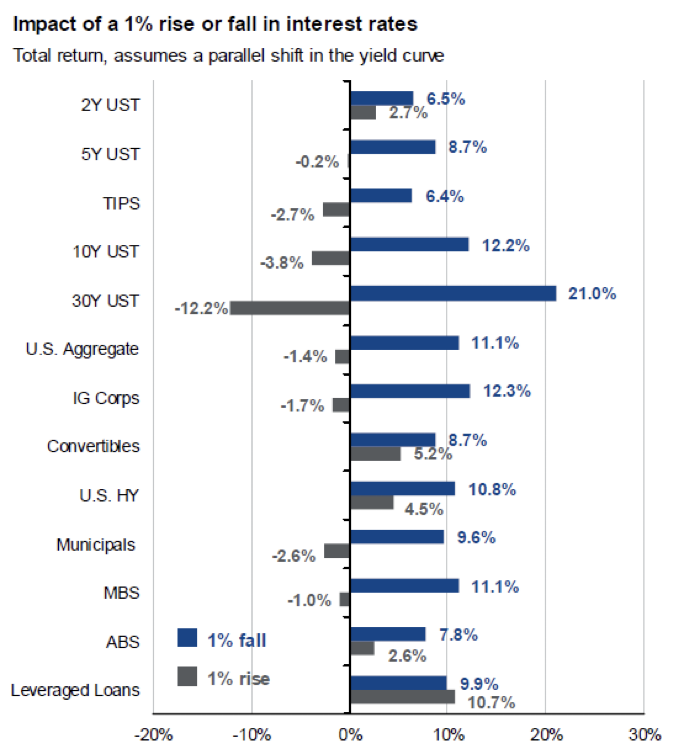

In 2021 and 2022, the loss on an intermediate or long-term bond portfolio if rates rose 1% was higher than the potential gain if rates decreased 1%. With rates having risen substantially, the equation now provides investors with more upside on a 1% rate decrease than downside on a rate increase (a concept called convexity). This opportunity makes longer-term bonds more attractive in today’s environment. The following chart shows the positive convexity effect on 12-month returns across the Treasury curve assuming various parallel shifts in interest rates.

Importantly, Verum’s overall bond allocation continues to hold a position in short-term bonds; but increasing duration reflects the Investment Committee’s view that we see increasing relative value across the bond market. We see bonds now that are providing positive inflation-adjusted returns for the first time in a long time, and extending duration could lock in compelling returns. To us, investing is about positioning portfolios across asset classes such that you are raising your expected future returns while controlling appropriate risk levels, and we feel this move directly aligns with that philosophy.

Bottom Line

The bottom line is that our perspective on extending duration beyond a short-term posture is one we feel offers investors more potential upside than downside risk, and can be summarized in three key points:

- Locking in Yields: By moving into bonds with longer durations, we aim to lock in potentially higher yields over the long term. This can provide a more stable income even if interest rates fluctuate.

- Capitalizing on Rate Changes: If interest rates drop in the future, longer-term bonds tend to see greater price appreciation. If bonds appreciate, they will effectively pull forward the future yields through the increase in each bond’s price. Lengthening duration positions for a benefit from potential rate decreases.

- Diversification: Adding bonds with longer durations can also help diversify our portfolio, spreading risk across different types of bonds and maturities.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor. The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. For additional information, please visit: https://verumpartnership.com/disclosures/

Be the First to Know

Sign up for our newsletter to receive a curated round-up of financial news, thoughtful perspectives, and updates.

"*" indicates required fields