Summary:

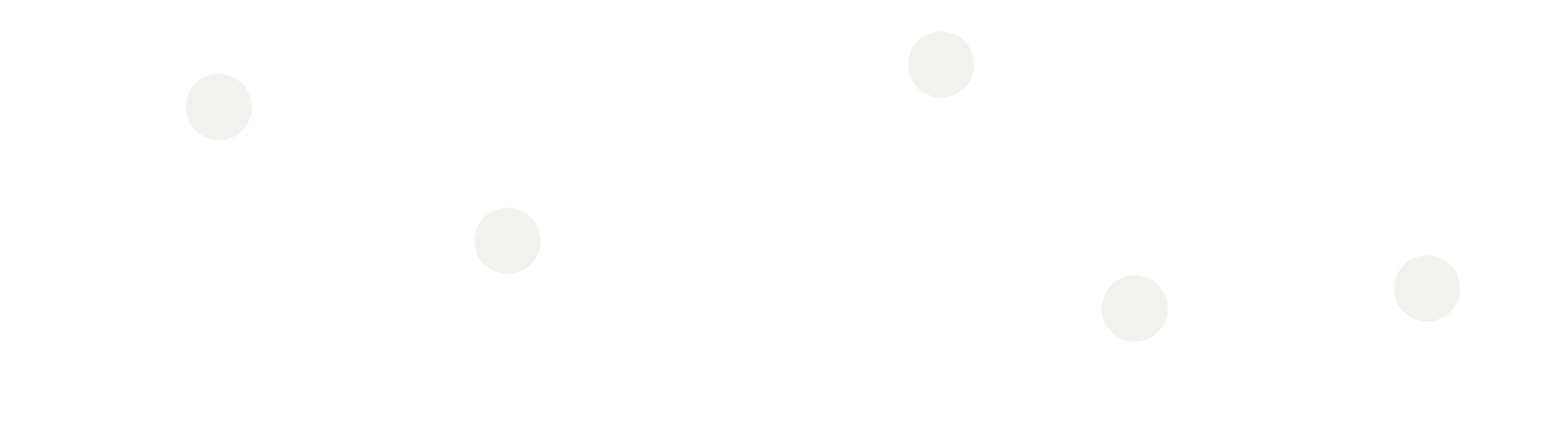

- The Great Pandemic bear market was the fastest 10%, 20%, and 30% market downturn from an all-time high in market history.

- Last week’s three-day rally was historic on many fronts. It was one of the fastest and strongest rallies we have ever seen.

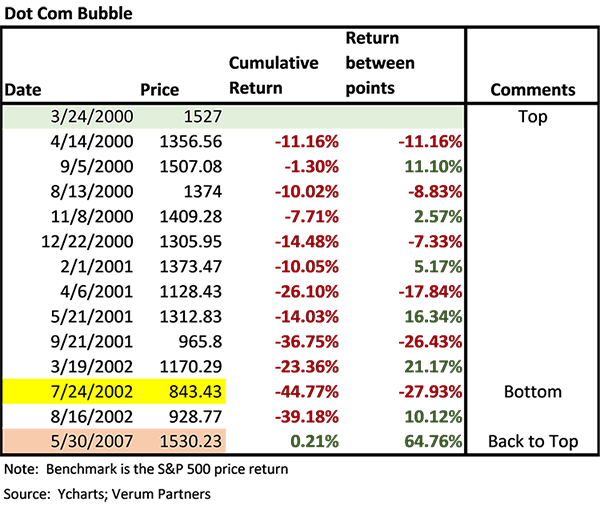

- When past bear markets are analyzed we observe that all bear markets have strong rallies, but most have not seen the speed and strength of such a rally this early into the bear market. The recent rally was stronger than any bear market rally from the 2008 or 2000 bear markets.

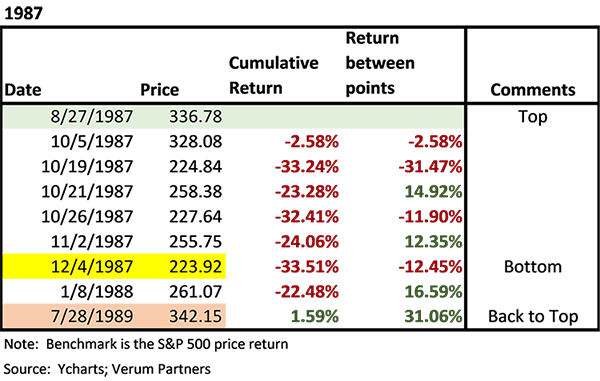

- 1987’s crash offers the most parallels to the Great Pandemic but given 1987’s lack of economic destruction relative to the pandemic, we question whether it’s truly a blueprint.

- The 1929 crash does have some similarities in price action. However, for a variety of reasons we believe comparisons to 1929 are unfounded and ignore a variety of key underlying fundamental economic drivers and government responses.

- We ultimately don’t know if we have put in a market bottom. We suspect that we will continue to see historically elevated volatility for the coming weeks and could likely test the recent bottom or make new bottoms as markets come to grips with the economic shutdown.

- While this rally is more likely to end up being a bear market rally than a bull market, investors should use last week as a reminder that the best days often immediately follow the worst days. Trying to time markets during these periods is nearly impossible. Selling during the pain to sit out a few hands could be utterly destructive to your wealth.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor. The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. For additional information, please visit: https://verumpartnership.com/disclosures/