- The speed of the fall and the speed of the recovery made it hard to buy and easy to sell: Absent the 1987 crash (which wasn’t accompanied by a full shut down of the economy or even a major recession), past bear markets have taken time to play out. After the dot com bubble burst, it took 42 months for the market to fall from its peak to its trough, and it took another 49 months from the trough to recover to fresh all-time highs, nearly 8 years after its previous high. (Notably the Great Depression saw a more than 20-year gap between all time highs). In the 2007-2009 financial crisis, the market took 17 months to fall from its high to its low. It took 36 months for the market to claw its way back from the bottom to the top. In 2020, we took just over 1 month to fall from all-time high to low and it took just over 4 months to reach a new high. The study of psychology tells us humans experience actual emotional pain when they see assets that they own going down. Interestingly, the size of the pain can be quantified by both how much the asset falls and the time it takes to fall. A long, drawn-out fall in prices is far more painful than a sharp drop. It seems that the psychologists have this one right. The speed of this fall left many feeling less pain than they otherwise would and has led to a euphoric rise in prices on the way out. Many investors, Mr. Warren Buffett included, were left waiting for more pain. The lesson learned is to stay invested and stay disciplined with the plan you entered the crisis with. If markets move at historic speed to the downside and sharp deleveraging is taking place, it’s probably worth moving as quickly as you can to rebalance and add risk, even if it hasn’t taken long enough for actual pain to be felt.

- This Wasn’t The End of the Economic Cycle – It Was a Meteor Strike: In Howard Marks’ most recent memo titled “Time For Thinking,” he wrote, “a moderate recovery – marked by reasonable growth, realistic expectations, an absence of corporate overexpansion and a lack of investor euphoria – was struck down by an unexpected meteor strike.” This quote made me rethink the framing of the impact of COVID-19 on markets. If COVID-19 had happened at any time and at any phase of an economic cycle it would have caused a deep recession. It’s important to think about the COVID-19 crisis as a meteor strike, not as the end of the cycle. We are not in the early innings of a new bull market; in fact, we may be in the very late stages of a broader cycle that begin in March 2009. For more on this topic, check out this post that covers this in greater depth.

- The “Get Rich Quick crowd” that emerged from hibernation in 2017 and 2018 is back with a vengeance: In 2017, while working for a different financial services firm, I wrote that the Get Rich Quick crowd was back for the first time since 2007. Bitcoin, cannabis stocks, electric vehicle stocks, and selling volatility short were all taking their turn in the spotlight with huge run ups in value and returns. Each of those phenomena has gone through booms and busts. I’m not arguing the potential value of any of these strategies in isolation but rather the emergence of rampant speculation. Rampant speculation in 2020 has taken on a whole new meaning. This has pushed valuations of many speculative companies to levels not seen since the late 1990s. We all know how that ended, and we certainly wouldn’t be surprised to see some sort of market event to flush the speculators out. Until then, we hold on for dear life. In late 2020 we are seeing many strange events such as huge run ups in bankrupt companies, buying into an already failed ETF, and mind-blowing buying in certain biotech, pharma, and electric vehicle companies. We’ve also seen at least one sports media entertainer build and lead a comical but amusing day trading effort daily on social media. The euphoria is back in a big way. Take note!

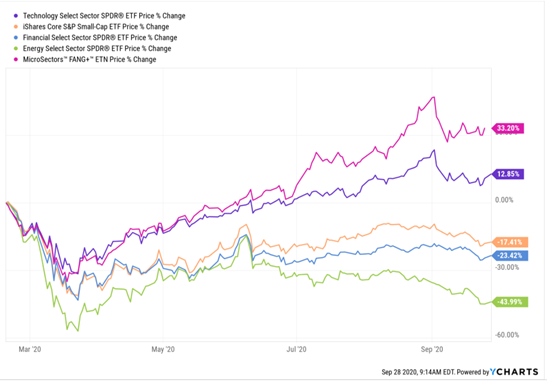

- Forecasting is still impossible, even with supercomputers and nearly infinite information: Despite media coverage of the few folks who had outstanding returns shorting or hedging the market during COVID (and nearly all of these folks have had terrible returns for the past 10 years), the reality is that the market did not see this coming. The market was at all-time highs less than 5 weeks before the global economy fully shut down. Further, valuations would have predicted lower returns for certain large growth stocks and meaningful relative returns from lower valuations stocks. So much for that! Prior to COVID, a very objective case could be made that small cap stocks were cheap relative to large technology stocks. The same case could be made for financials vs. technology. In addition to technology, the very large mega cap “FANG” stocks or FAAMGN were becoming stretched (despite most of these companies being great companies). Even with high revenue and earnings growth, tech was priced to perfection and would have needed to shoot the moon to generate the outsized returns that tech received over the past 10 years. But valuations don’t matter when hit by an exogenous event. COVID pulled forward much of the growth for the large tech companies for many years. Prices have risen to staggering levels. Here are the returns of those market segments since that day. Despite the recent “tech wreck,” the tech companies have absolutely dominated the cheaper companies.

- All broad-based equity indexes are now heavily weighted toward technology and tech-oriented stocks: Over 50% of the S&P 500 weights are now in technology or healthcare related sectors. The sector concentrations are larger than in history. Sixteen of the top 25 names in the S&P 500 are either tech related or healthcare related. If you add in mobile payments, that number goes to 18, leaving just Berkshire Hathaway, JP Morgan, Proctor & Gamble, AT&T, Verizon, Home Depot, and Disney. Note that nearly 40% of Berkshire’s equity portfolio is Apple; and AT&T, Verizon, and Disney are all in the communications sector and could be considered tech oriented. But that’s not all. If you look at the Emerging Markets broad-based index, you see that 17 of the top 24 companies are tech oriented. Most of those companies reside in China or greater Asia. Lastly, when we look at the All Country World Index, which comprises all of the largest companies in the world regardless of where they are located, and weights them based on market value, you see a similar result: 9 of the top 10 names are tech stocks, and the remaining stock is J&J, a healthcare company. We are believers in indexing. Indexing works well and has over a long time period. We don’t want to disparage anyone who decides only to index their entire portfolio, but we believe portfolios that only hold market cap weighted indexes should recognize they are taking a huge bet on just a couple of sectors. The last time we saw such a phenomenon was the Nifty Fifty craze in the middle of the last century. That carried on for a long time, but ultimately prudent investing gave way to speculation and hot money, and finally led to very poor results. We believe that indexing should be a part of a portfolio, but overreliance could lead to disappointing results when the speculation ends.

- A lot of people have used COVID-19 as a wake-up call to reassess their priorities when it comes to family, business, and travel. This is leading to a great deal more employee turnover, executive severance packages, property transactions, and business sales than we would have ever predicted: In our field, we get a look inside of a lot of industries. What we are observing right now is there are many executives, particularly in white collar industries that require lots of travel, such as sales, financial services, and consulting, who have taken stock of their lives and are deciding to leave their jobs. Additionally, we have witnessed business sales increasing as of late. We suspect that many of these sales were going to happen over the next few years, but owners decided to take chips off the table as soon as capital markets thawed.

- Call it a V or a W or a K economic recovery – call it whatever you want – but one thing we now know is that regardless of the speed of the economic recovery the economy will forever be changed because of 2020: We will see recessions and recoveries and booms and busts just like we always have, but some areas of the market are on an exponential growth curve (e.g., virtual work, virtual learning, single family housing in growth markets, and e-commerce) while other areas of the economy will be forced to reinvent themselves and in some cases die (e.g., certain retail oriented businesses, shopping malls, higher education, traditional high rise office buildings in dense urban areas, traditional energy companies, and large cities).

- Despite a quiver that seemingly had few arrows left, the adage “Don’t Fight the Fed” is as relevant as ever: Modern Monetary Theory (MMT) was once a theory but now it’s effectively a reality. Not only has the Federal Reserve used its primary tools of setting interest rate policy but it has gone many steps past those tools and now is a buyer of high yield and investment grade corporate bonds, municipal bonds, and esoteric structured credit. The Fed injected capital in just about every way that it could to try to stave off the crisis. There are plenty of Fed bashers, and this note is going to refrain from the bashing. The Fed did what it felt it needed to do. For many years, we have worried the Fed was likely inadvertently distorting pricing on many risky assets. By holding risk free rates near zero for so long it forced many investors to take on additional risk. It has also kept many businesses alive for far too long due to extremely low borrowing costs and a broad search for excess return (see Softbank and WeWork as prime examples). Everything from high yield bonds to real estate to Tesla has seemingly been inflated due to cheap capital. If you think the last 10 years was a wild yield chase, you may have not seen anything yet. Our bet is that we are entering one of the most exaggerated return/yield chases in history. Investors who require a certain return to meet their objectives will not be able to rely on simple portfolios to achieve those returns. Investors need either to prepare for lower returns or be willing to take excess risk to achieve them.

- History left out the most important clause of the famous adage “buy when there is blood in the streets.” This came from a quote from Baron Rothschild, but the full quote was “buy when there is blood in the streets, even when it is your own.”: In March we wrote that after this event was over everyone would look back with regret at not having bought more. Despite trying to do our best to buy, we wish we had owned more stocks in late March than we did. At times of despair and at times when blood is in the streets it becomes very hard to take Rothschild’s advice because the blood in the streets is yours. The key is recognizing that everyone is bloodied, and that fortunes are made by those who, while bloody, are still standing and are buying despite the pain that they feel.

- COVID-19 has disproportionately impacted, from both a financial and health perspective, those who have less access to financial resources and healthcare. The widening gap of wealth and wellbeing in the United States is continuing to soar with no end in sight, and carries both personal tragedy and broader systemic implications: There will likely be consequences of this societally and politically. We have already seen political movements over the last four years that look more like European nationalism and socialism than traditional U.S. red vs. blue politics. These movements are only gaining steam and are having an impact on the platforms of both the Republican and Democratic parties nationally. It’s important to note that investing according to your political views has historically been a very bad strategy. Wealth inequality and social unrest are important political issues and should be treated as such. When it comes to financial decisions, be very careful to invest only with your heart, but be aware of the possible implications that extreme policy ideas coming from both sides of the aisle could have for investment portfolios.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor. The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. For additional information, please visit: https://verumpartnership.com/disclosures/

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information, and it should not be relied on as such.