When you commit your money to the market, are you aiming for long-term growth or chasing short-term gains? The strategy you choose is critical, as it shapes how you build and sustain your wealth. At Verum, we believe in a disciplined approach to investing, focusing on long-term success through a structured process that emphasizes thoughtful asset allocation, robust diversification, and consistent discipline.

Building an investment portfolio that is optimized for the long-term is both an art and a science. The goal is to maximize returns while effectively managing risk. Achieving this balance requires creating what is known as an “efficient portfolio”—one that offers the highest possible expected return for a given level of risk. One of the most powerful tools for constructing such a portfolio is the Efficient Frontier, a concept rooted in Modern Portfolio Theory (MPT), which was developed by Harry Markowitz in the 1950s. This concept helps investors identify the best possible portfolio, offering the maximum expected return for a given level of risk.

Understanding the Basics of Portfolio Construction: Risk and Return

Before diving into the Efficient Frontier, it’s important to grasp two fundamental concepts: risk and return.

- Return: This is the profit (or loss) you expect to make from an investment over a specified period, usually expressed as a percentage.

- Risk: This is the uncertainty associated with achieving the expected return. In financial terms, risk is often measured by the standard deviation or variance of returns. Standard deviation is merely the statistical departure from the mean, or the extent to which actual returns vary from the average return. A higher standard deviation indicates a more volatile, and therefore riskier, investment.

The primary goal of investing is to maximize returns while minimizing risk. However, since higher returns generally come with higher risks, investors must carefully balance the two—a challenge that brings us to the Efficient Frontier.

What is the Efficient Frontier?

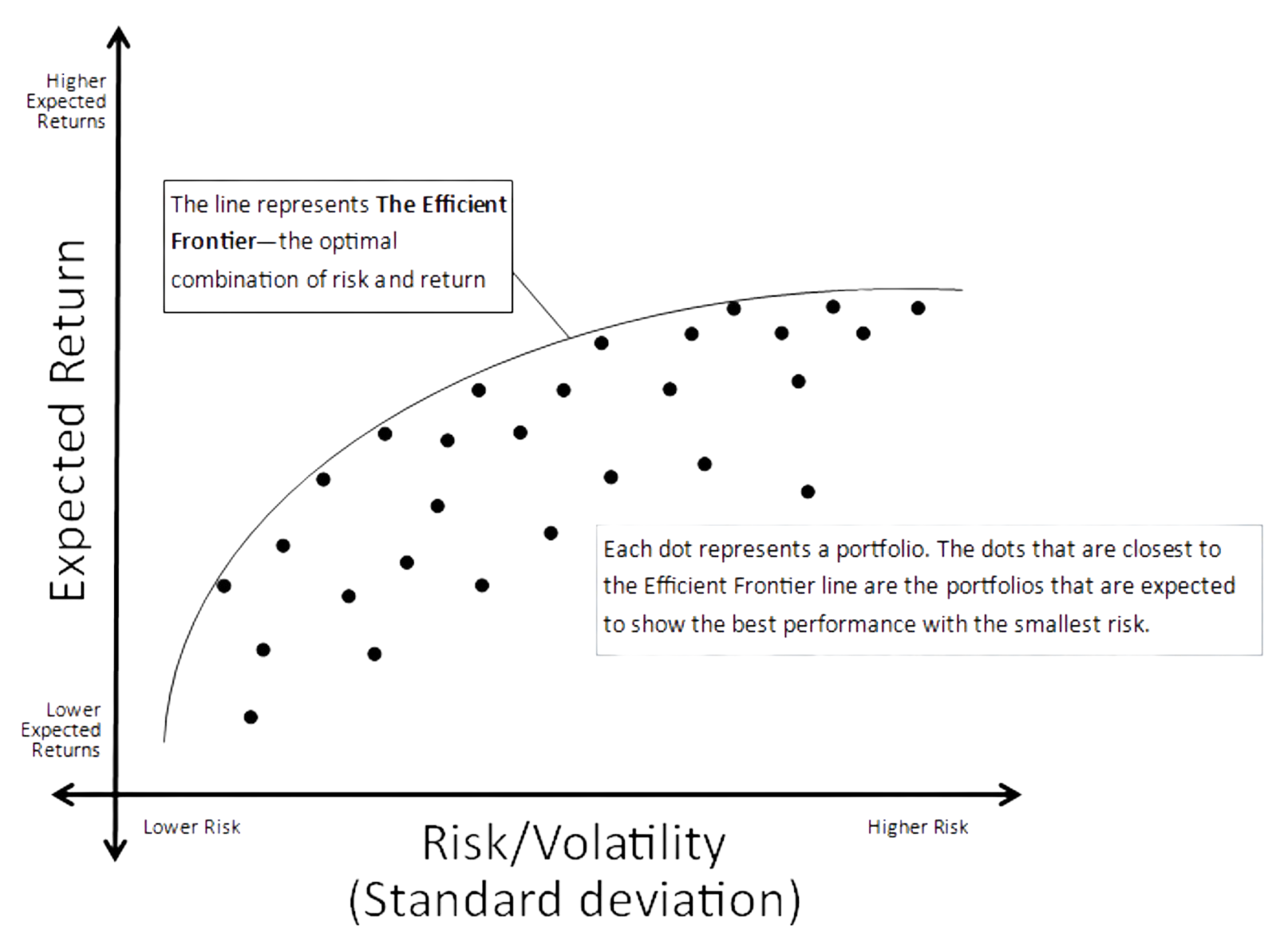

The Efficient Frontier is a curve that represents a set of portfolios offering the highest possible expected return for each given level of risk. This curve illustrates the trade-off between risk and return, which is at the heart of any investment decision. Portfolios that lie on this curve are considered “efficient” because no other portfolio can offer a better return for the same amount of risk or a lower risk for the same return. Portfolios that fall below the curve are suboptimal, as they offer lower returns for the same level of risk. Portfolios above the curve, theoretically, do not exist because they would imply higher returns without taking on additional risk, which is not feasible.

Source: Benzinga

The Significance of the Efficient Frontier

The importance of the Efficient Frontier lies in its ability to visually and quantitatively guide investors in making informed decisions about their portfolios. Here’s why it matters:

- Maximizing Returns for a Given Risk: The Efficient Frontier helps investors identify the portfolios that provide the best possible return for their chosen level of risk. For instance, if you are willing to accept a certain amount of risk, the frontier shows you the portfolio that should, theoretically, offer the highest return for that risk level.

- Avoiding Suboptimal Portfolios: Portfolios that fall below the Efficient Frontier are suboptimal. They offer lower returns for the same risk compared to portfolios on the frontier. By understanding and applying the Efficient Frontier, investors can avoid these less efficient portfolios, thereby optimizing their investment strategy.

- Guiding Portfolio Diversification: The Efficient Frontier also highlights the importance of diversification. Since the frontier is built by analyzing different combinations of asset classes and their correlations, it underscores how a well-diversified portfolio can reduce risk while maintaining or even enhancing returns.

Steps to Build a Portfolio Using the Efficient Frontier

- Identify Asset Classes: We begin by selecting a broad range of asset classes, such as equities, fixed income, real estate, and commodities, to include in a portfolio.

Diversifying across these different asset classes increases the potential for creating a well-balanced, optimized portfolio, as each class typically responds differently to market conditions. - Calculate Expected Returns and Risks: Calculate the expected return and risk for each asset. At Verum, we approach this on a forward-looking basis, updating our capital market assumptions annually to estimate the level of risk and return for each asset class over the next 10 years. This process takes into account the level of interest rates and starting valuations within each asset class relative to historical levels and ranges.

- Determine Correlations: Assets in a portfolio don’t exist in isolation; their returns are often correlated. The correlation between assets is crucial because it determines how they interact with each other. A well-diversified portfolio contains assets that are not perfectly correlated, meaning their returns do not move in lockstep. This helps to reduce overall portfolio risk.

- Generate Possible Portfolios: By utilizing software programs, we can create a wide range of potential portfolios by varying the amount allocated to each asset class. These programs can quickly calculate the expected return and risk for each portfolio, helping to efficiently explore different combinations and identify optimal portfolios that align with our investment philosophy.

- Plot the Efficient Frontier: Once we have generated a set of potential portfolios, we plot their risk (standard deviation) on the x-axis and their expected return on the y-axis. This process allows us to visualize the Efficient Frontier, which forms the curve at the upper boundary of these points. The portfolios along this curve represent the most efficient options, offering the best possible returns for each level of risk. Creating the final efficient frontier is more art than science. While following a disciplined process is the key underpinning of creating an optimized portfolio, the analyst or committee must also test themselves and their assumptions to understand where the model may be overly sensitive or overly reliant on just one input. An efficient frontier process must always be iterative.

- Choose the Optimal Portfolio: The optimal portfolio along the Efficient Frontier will depend on your risk tolerance. A risk-averse investor might choose a portfolio at the lower left end of the curve, offering lower risk but also lower returns. Conversely, an investor willing to accept more risk for potentially higher returns might select a portfolio farther up the curve.

Conclusion

Building an investment portfolio using the Efficient Frontier is a disciplined process grounded in rigorous analysis of risk and return. By carefully selecting assets, calculating their expected returns and risks, and understanding their correlations, you can construct a range of portfolios to identify those that offer the best possible returns for each level of risk. The Efficient Frontier provides a visual guide to these optimal portfolios, helping to achieve a balance that aligns with your financial goals and risk tolerance. Leveraging this approach can help make informed, data-driven investment decisions that enhance a portfolio’s long-term performance and avoid common risk management pitfalls.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor. The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. For additional information, please visit: https://verumpartnership.com/disclosures/

Be the First to Know

Sign up for our newsletter to receive a curated round-up of financial news, thoughtful perspectives, and updates.

"*" indicates required fields