Most of us know about the tax benefits offered by employer-sponsored retirement plans and individual retirement accounts, but there is a lesser-utilized yet more-powerful vehicle – a Health Savings Account.

What is a Heath Savings Account?

A Health Saving Account (“HSA”) is a tax-advantaged account intended to help people save for Qualified Medical Expenses as defined by the IRS (See Publications 969 and 502). Participants must be covered under a High Deductible Health Plan (“HDHP”) to be eligible to make contributions.

Often confused with Flexible Spending Accounts (“FSAs”), HSAs are different in that the money contributed is not “use it or lose it” like FSAs. HSAs are also portable since they belong to the account owner (not the employer) and balances remain available to use even if you change health coverage from a HDHP.

To help with the rising costs of health care, HSAs have been increasing in popularity since their establishment in 2004. Although more common, they are rarely utilized to their full potential as a tax-advantaged retirement savings vehicle.

Tax Advantages

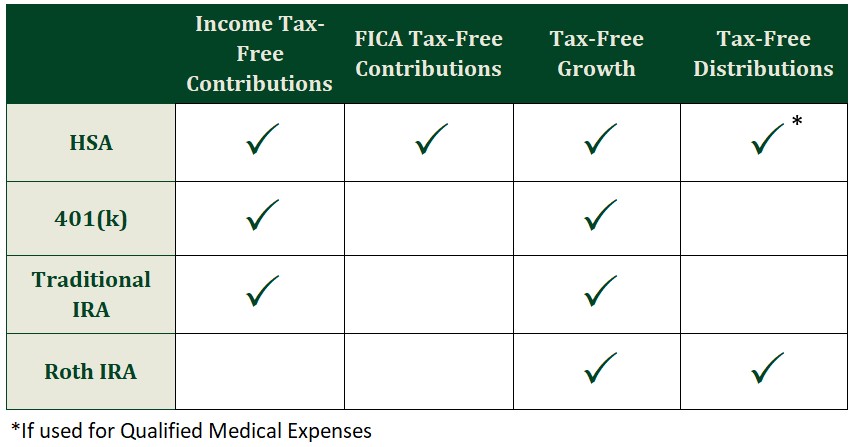

HSAs are the most tax-advantageous vehicles out there. They boast the following tax benefits:

- Pre-tax contributions

- Contributions reduce income for purposes of the 7.65% FICA taxes

- Tax-free growth inside the HSA

- Tax-free withdrawals for Qualified Medical Expenses

When compared to other retirement vehicles, it is clear that HSAs offer the most tax benefits.

Implementation as a Retirement Vehicle

Most utilize the HSA as a clearing account by contributing some pre-tax money, keeping the money in cash as opposed to investments, and spending on medical expenses as they arise. While we recommend at least contributing to an HSA to take advantage of the pre-tax benefit, using an HSA like an FSA doesn’t take advantage of tax-free growth. For those with sufficient cash flow to cover medical expenses, the more optimal way to treat your HSA is to follow these steps:

- Max out your HSA contributions (contribution limits in “Other Features” section below).

- Pay for medical needs out of your cash flow.

- Keep track of medical expenses paid outside of your HSA in case of an audit.

- Invest inside your HSA and let the power of compounding beef up your account over time.

- In retirement (or sooner, if the need arises), withdraw from your HSA for the medical expenses you previously paid out of pocket over the past years as well as medical expenses that arise in retirement.

This strategy essentially “reimburses” you for the medical expenses incurred while you had an HSA account open. The reimbursements don’t need to happen in the same year the expense was incurred.

If you don’t feel like dealing with the hassle of tracking your medical expenses paid out of pocket in order to perform a reimbursement later on, there is still an argument for letting your HSA compound over time until retirement. Fidelity recently estimated that “on average, a 65-year-old couple needs $300,000 to spend on health care over the course of retirement,” a dramatic increase from medical expenses in your younger years. Because of the likely increase to medical expenses in retirement, think of HSAs as a retirement account earmarked for medical expenses.

Other Features

Another great feature of HSAs is that after 65, non-medical withdrawals are penalty-free (withdrawals not used for Qualified Medical Expenses before 65 are taxed and subject to a 20% penalty). This gives added flexibility to utilize the funds as needed and have an extra source of income in retirement. On top of that, there are no Required Minimum Distributions!

Contributions are capped at $7,750 in 2023 for married filing jointly filers (with an extra $1,000 available for those 55 and older) regardless of income. Employers often make a contribution to your account as a benefit, so make sure your contribution together with your employer’s does not exceed the funding limit.

A Word of Caution

Before you potentially make the change to a HDHP with an accompanying HSA, make sure a HDHP makes sense for your medical needs. Typically, HDHPs make more sense for those with minimal recurring medical expenses, as opposed to those with a chronic condition or frequent doctor visits. Since each health plan lineup is different with its own nuances, compare your projected costs across each plan to help in your decision.

Summary

If nothing else, utilize your HSA for the pre-tax benefit to pay for current medical expenses and for the “free money” from your employer. To better optimize the features of an HSA, do your best to pay for medical expenses out of cash flow to allow the magic of compound interest plus tax benefits to work in your favor for the inevitable health care costs in retirement.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor. The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. For additional information, please visit: https://verumpartnership.com/disclosures/

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information, and it should not be relied on as such.

Be the First to Know

Sign up for our newsletter to receive a curated round-up of financial news, thoughtful perspectives, and updates.

"*" indicates required fields