Many investors are familiar with the term “asset allocation” – an investment strategy that balances risk and return by participating in various asset classes. Fewer are familiar with the term “asset location” – an investment strategy that seeks to minimize taxes by holding specific investments in different account types. After determining your proper asset allocation according to your goals, risk tolerance, and time-horizon, consider implementing an asset location strategy to boost after-tax returns and optimize your retirement distribution strategy.

According to Vanguard’s whitepaper on quantifying an advisor’s alpha, the amount of value added by applying an asset location strategy averages as much as 0.6% per annum on a net return basis. Certain individuals could even benefit beyond 0.6% depending on a variety of factors.

Let’s explore (1) the different tax treatments of common investment account types, (2) which investments are best to hold in each account type, and (3) who the asset location strategy applies to.

Different Account Types

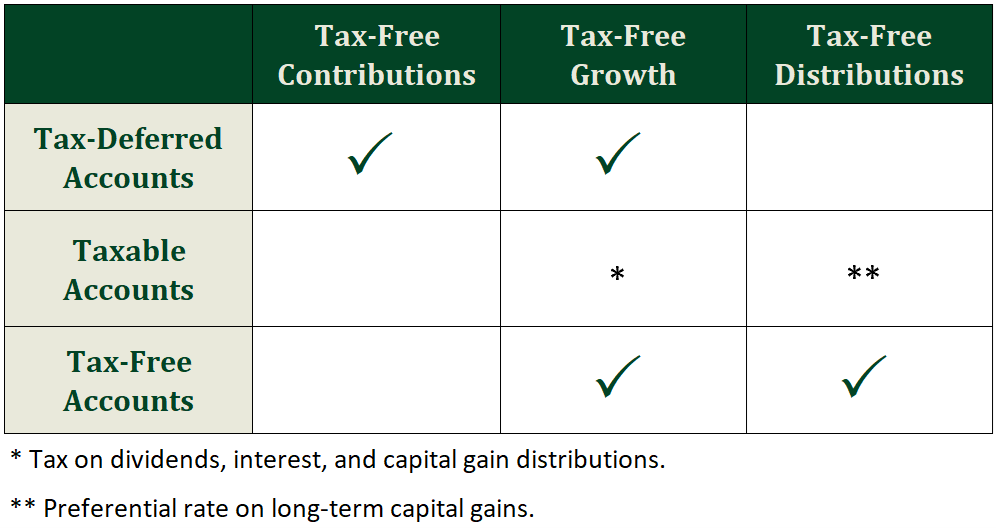

There are three common investment account types, each offering different advantages from a tax perspective.

- Tax-deferred accounts include traditional 401(k)s and IRAs. Contributions to these accounts (up to specified limits) are tax free and enjoy tax-free growth, but distributions are taxed at ordinary income rates (37% being the top marginal rate). These accounts also require that minimum distributions begin to be taken in your 70s, depending on your date of birth.

- Taxable accounts are your traditional brokerage accounts. Contributions do not receive a tax benefit and investment income and distributions are taxable. However, dividends and long-term capital gains are taxed at preferential rates of 0%, 15%, or 20% depending on your taxable income. The ongoing tax burden can be reduced but not necessarily eliminated through tax loss-harvesting and tax-sensitive portfolio management. These accounts also allow for a tax-free step-up in basis at death – eliminating future tax on unrealized capital gains.

- Tax-free accounts include Roth 401(k)s and Roth IRAs. Contributions do not receive a tax benefit, but the assets grow tax free and enjoy tax-free distributions.

As a reminder, there is a fourth account type that is less common yet more tax-efficient than any of the above account types – the Health Savings Account. Refer to our prior blog post here to learn more.

Which Assets Should I Hold in Each Account Type?

- Tax-deferred: Low-growth, tax-inefficient investments like taxable bonds and mutual funds that generate more in interest income and short-term capital gain distributions. The tax-deferred account type shields immediate taxes from portfolio income, but taxes distributions in the same way interest income and short-term capital gains would’ve been taxed anyway – at higher ordinary tax rates. By contrast, if the situation allows, you would rather not hold high-growth, tax-efficient investments in an IRA only to later have distributions be taxed at ordinary income rates! There is a better place for those assets. The goal is to not compound a future tax liability in the form of larger RMDs when there are better places for compounding to take place like your tax-free accounts.

- Taxable: Tax-efficient investments with low turnover result in more long-term capital gains taxed at preferential rates instead of short-term capital gains taxed at ordinary rates. Some examples include low-turnover, tax-efficient mutual funds and index funds, ETFs, tax-free municipal bonds, and individual stocks. We believe in implementing a tax-loss harvesting strategy within taxable accounts to create tax losses that reduce current tax liabilities (while maintaining targeted exposures). Realizing gains from highly appreciated securities can be mitigated by (1) offsetting with losses through tax loss harvesting, (2) getting a future a step-up in basis at death, and (3) using appreciated securities as the optimal “currency” to donate to charities completely tax free.

- Tax-free: High-growth investments with the largest expected return since distributions are tax free. Tax efficiency is not a concern here since there is no “tax drag” to the ongoing growth. Examples could include high-growth alternative investments, emerging markets equities, and small cap equities.

Who the Asset Location Strategy Applies to

We are believers that the tax tail should not wag the investment dog. The first decision to make is to come up with an optimal portfolio that maximizes return per unit of risk according to your risk tolerance. After that, an asset location strategy makes sense the more the following conditions are met:

- You have investments in taxable, tax-deferred, and/or tax-free accounts. We recognize everyone’s wealth building path is different, and not every investor will have assets built up in each of these account types. However, access to even two of the three account types indicates that there could be room to implement the approach.

- You are in a high marginal income tax bracket. The higher your tax bracket, the more you pay in taxes on interest income coming from your taxable account each year. The impact of the “tax drag” from interest income being taxed at 37% is larger than for someone in the 12% bracket. Withdrawals from tax-deferred accounts are also taxed at your marginal rate.

- You want flexibility to control taxable income in retirement. The presence of these three different account types with an ideal asset location allows you to optimally manipulate your taxable income in retirement depending on your income needs. Ideally, we want to have (1) preferentially taxed withdrawals from a growing taxable account that gets a step-up in basis at death, (2) no tax on withdrawals from a growing Roth IRA, and (3) unfavorably taxed withdrawals from a diminishing IRA balance. We don’t know what the tax code will look like in the future, but it is likely to look different than it is today. Having an asset location strategy among various account types decreases tax risk uncertainty by allowing for choices when it comes to producing retirement income.

- You have a long-term time horizon. The benefits of an asset location strategy compound over time. Although the tax benefits may feel small in the beginning, the growth and optionality gained will be felt in the long run.

Conclusion

Within an overall balanced portfolio, each account type does not have to have the same investment mix. However, it is still prudent to consider account-level risk to avoid the scenario of a market downturn depleting higher-risk accounts. There is an art and a science in portfolio construction and asset location, with many factors at play. Typically, we recommend holding lower growth, tax-inefficient assets in tax-deferred accounts, tax-efficient assets in taxable accounts, and high-growth investments in tax-free accounts.

Choosing where to locate each investment is part of the big puzzle that is your financial picture. Having an adviser can help customize an asset location strategy that increases after-tax returns and set you up for an optimal retirement withdrawal strategy.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor. The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. For additional information, please visit: https://verumpartnership.com/disclosures/

Be the First to Know

Sign up for our newsletter to receive a curated round-up of financial news, thoughtful perspectives, and updates.

"*" indicates required fields