With the start of a new year, many people find themselves revisiting a familiar question when it comes to saving to retirement accounts – “Should my contributions be Roth or Traditional?” Few retirement planning topics generate as much discussion. The conversation often gets reduced to a single question and answer: Will your tax rate be higher now or later? If higher in the future, go with Roth. If higher now, go with Traditional. While that question surely matters, it oversimplifies what is actually a multi-layered planning decision with additional nuance.

Roth vs. Traditional: Structural Differences

At a basic level, the Roth vs. Traditional account difference is simple:

- Traditional (pre-tax) contributions reduce your taxable income today. You get an immediate tax deduction, but withdrawals in retirement are taxed as ordinary income.

- Roth contributions are made with after-tax dollars. There’s no upfront deduction, but qualified withdrawals are tax-free.

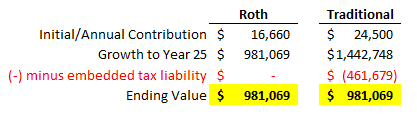

If your tax rate is exactly the same today and in the future, most argue that the math does not favor one over the other, pointing to an example similar to this.

This example assumes a 32% tax rate currently and later on, with a 6.5% expected return. The contributions to a Roth account are adjusted downward to account for being “more expensive” because of the lack of a tax break that a traditional pre-tax contribution benefits from. The argument then is distilled down to, “What will my tax bracket be now versus in the future?” If relatively lower now, Roth makes sense; and if relatively higher now, traditional makes sense.

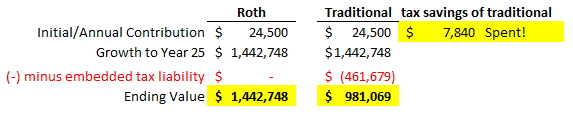

While the prior example is mathematically accurate, in practice, it usually looks something more like this:

Under this example, the tax savings that traditional contributions benefit from are usually spent. As a result, Roth contributions are a forced savings mechanism that can result in a higher ending balance after taxes.

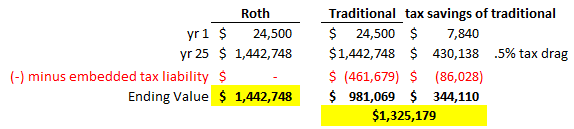

One might be thinking, “Well, I would invest that $7,840 – how does that affect this decision?”

Here is where a lot of the nuance lies. For the most disciplined savers and investors, the dollar amount of the tax savings from the traditional pre-tax contributions is often added to a taxable investment account. This choice makes sense for those wanting to continue to build wealth after maxing out various retirement accounts. However, inherent in a taxable account are a few things: 1) tax drag and 2) future unrealized gains.

Tax Drag, Unrealized Gains, and After-Tax Wealth Accumulation

“Tax drag” refers to the interest, dividends, and capital gains that investments pay out each year and are reported on your 1099. However, tax drag can be mitigated by a few things, like tax-efficient ETFs and tax-loss harvesting.

Taxable investment accounts also result in unrealized gains. Although taxed at preferential capital gains tax rates when sold, there is often an embedded tax liability that’s triggered by using money from these accounts. However, to offset these embedded gains, investors often contribute highly appreciated stock to satisfy charitable goals and/or let the basis get stepped up at death.

Look how ending values compare when factoring in tax drag and unrealized capital gains when savings are used to invest in a taxable account. This example keeps tax rates the same at 32% now and in the future, but Roth comes out ahead.

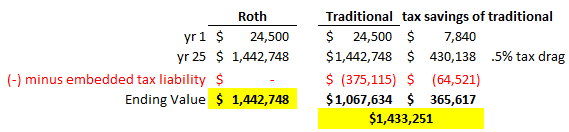

Now look at what happens when tax rates drop in retirement from 32% to 26%. The ending values are very close to each other, with Roth coming in slightly higher. This shows that conventional wisdom of only contributing to Roth if you are in a lower bracket today isn’t always the right answer.

None of this means Roth is always better. Traditional contributions can be very effective when current marginal tax rates are high, and a future low-income window is likely (gap year(s) after business sale, the “income-valley” years after retiring but before RMDs and Social Security income start, etc.). There might be a great opportunity for planned Roth conversions at lower tax rates as opposed to contributing straight to Roth to begin with.

Tax Diversification as a Risk-Management Strategy

The key is intentionality and planning. We are currently in a historically low tax regime, but where tax rates will be in the distant future is unknown. It also helps to have “tax diversification” – different pockets of savings across all three account types you can pull from when planning for the future: taxable, tax-deferred (traditional), and tax-free (Roth).

Like most personal finance questions, the right choice depends on your unique circumstances, preferences, and goals.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor. The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. For additional information, please visit:https://verumpartnership.com/disclosures.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information and it should not be relied on as such

Be the First to Know

Sign up for our newsletter to receive a curated round-up of financial news, thoughtful perspectives, and updates.

"*" indicates required fields