2024 Election Investment Guide: Lessons from History and Staying the Course

As the contentious 2024 election between Kamala Harris and Donald Trump nears its conclusion, many investors find themselves anxious about what market shifts could occur post-election. However, history teaches us that trying to predict market movements based on political outcomes is fraught with uncertainty. As an example, in 2016, several pundits predicted a BREXIT-like market crash after Donald J. Trump’s victory, only to witness a strong rally shortly after the results were announced. Similarly, pundits have historically predicted doom and gloom for certain sectors after an election’s outcome becomes apparent, only to find that this sector becomes one of the best performing sectors during the president’s tenure (examples: tobacco companies flourished during the Obama administration, tech stocks did great under Trump while energy was the worst performing sector, and Biden’s administration has seen the energy companies massively increase profitability and stock prices). There seems to be little correlation between the price of stocks and the outcome of elections.

The complexity of global markets, influenced by more than just politics, shows that it’s nearly impossible to tie market performance to election results alone. Instead, investors should focus on capital market and economic fundamentals that have historically driven returns. Capital market fundamentals include equity valuation, availability of credit, real interest rate levels, and corporate investment. Important economic fundamentals include unemployment rate, changes to workforce participation, new household formation, and consumer balance sheet health.

The Politics-Market Disconnect

It’s tempting to believe that a particular candidate’s victory will lead to predictable market outcomes, but history repeatedly disproves this. From Trump’s post-2016 election stock market rally to the Clinton administration’s thriving economy despite initial fears, political outcomes rarely result in the market shifts people expect. While elections can bring short-term volatility, long-term market performance is more closely tied to corporate earnings, innovation, and global events, than to who holds political power.

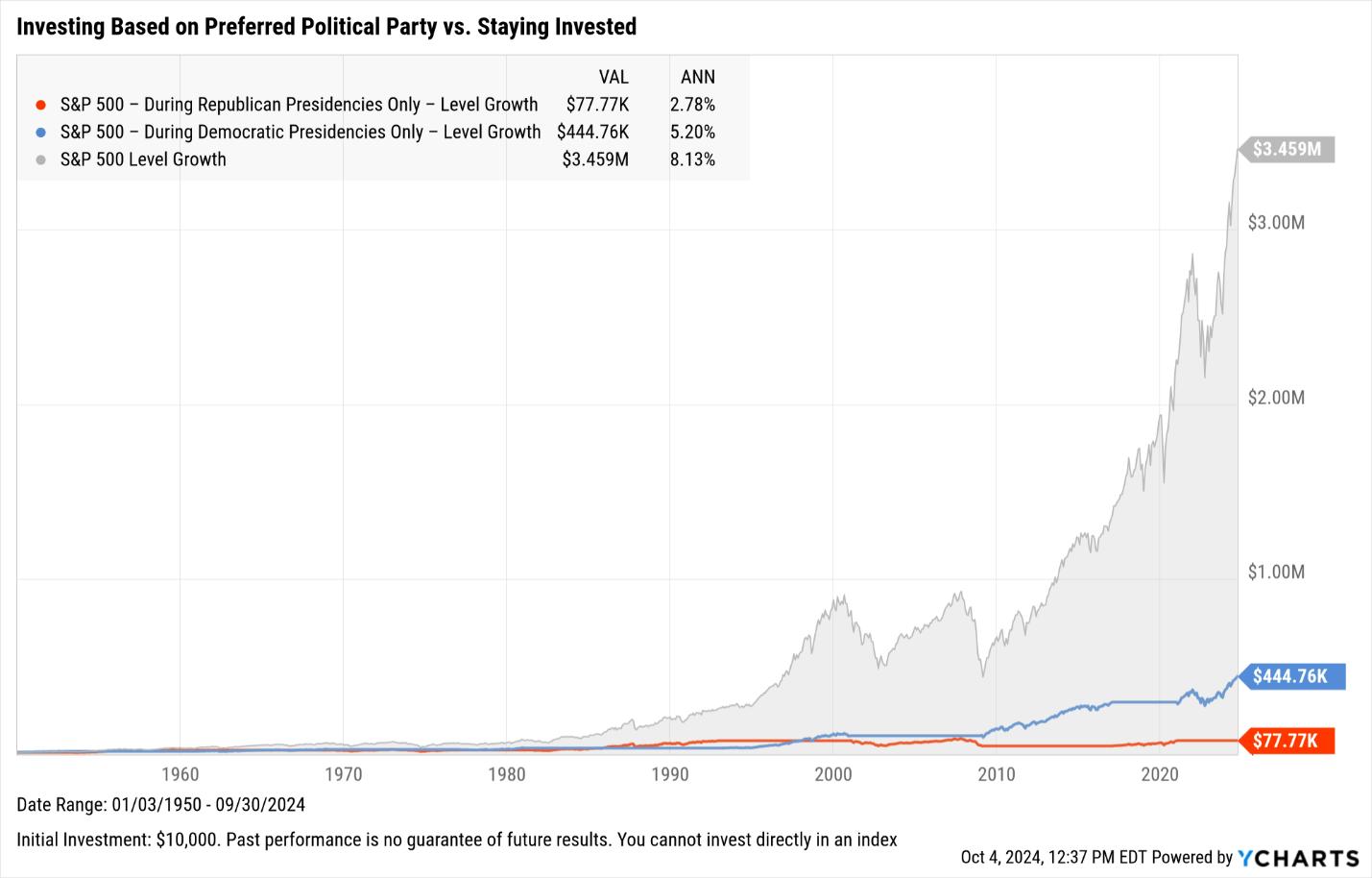

The takeaway is clear: markets are complex, and reacting impulsively to political news is often counterproductive. The chart below shows investment results of a hypothetical investor if they decided to exit and enter the markets based on who lived in the White House. The results are clear: time in the market beats any sort of political market timing and it seems to consistently, time and time again:

Politics Impact the Markets – But Not Predictably

Politics do matter, and policies from either administration can influence certain sectors. For instance, Harris’s policies may impact areas like healthcare and clean energy, while Trump’s policies could affect deregulation and fossil fuel industries. However, the effects are often muted or play out differently than expected. Why? Markets respond to a myriad of factors, including interest rates, corporate profitability, and global economic trends. Predicting the exact market impact of a political outcome is akin to solving an unsolvable puzzle.

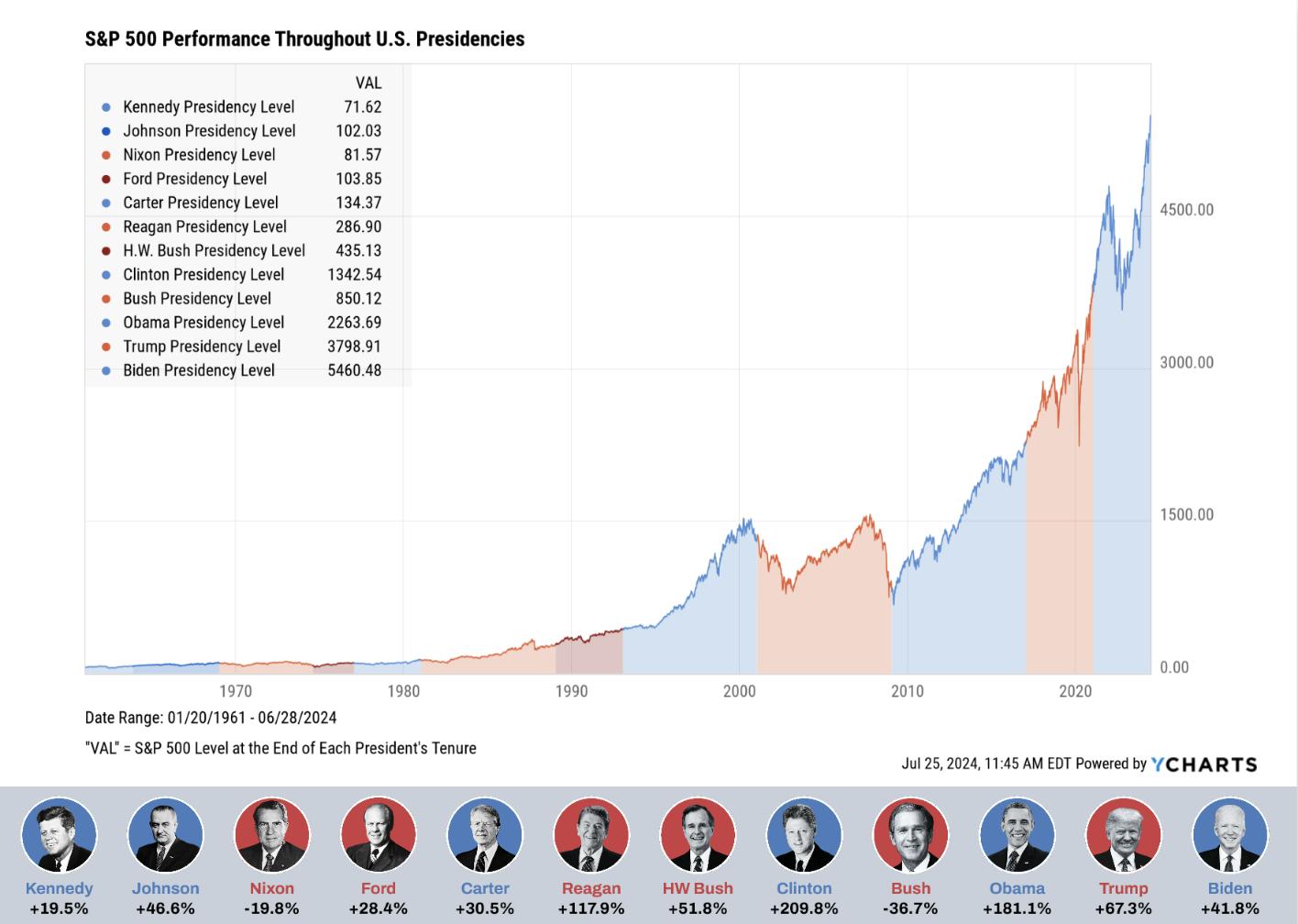

While it might be tempting to assume that one party’s policies will significantly boost or hinder the stock market, the data doesn’t support this. Over the last century, markets have generally risen regardless of which party holds power. Thus, focusing too much on political control misses the broader economic picture. Below is a chart from YCharts showing the S&P 500 across several administrations. Importantly, the two negative returns on the board – George W. Bush and Richard Nixon – both presided over substantial bull markets for most of their presidencies but experienced two of the worst bear markets at the ends of their respective presidencies. While pundits and historians alike can point to causes and effects around presidential policies and stock market gains, we suspect that most of the discrepancy of returns across administrations can be explained by sequence risk and equity market valuations at the beginning of their presidential tenure. – These two concepts are extremely important for folks nearing, entering, or in retirement and is a topic for a future blog post.

The True Market Drivers:

Profitability

The value of an investment is and always will be the present value of future cash flows. Companies that can create and grow earnings will ultimately be rewarded with higher values. A lot goes into profit creation, but, importantly, our economic system rewards those that win the competition for earnings. Competition can often lead a company with high profitability to be disrupted and ultimately become irrelevant (examples include Blackberry/RIM, IBM, Sears Roebuck, Blockbuster Video, General Motors, and many more). Investing in a broad swath of companies across the globe both protects against this company-specific risk but also ensures that your portfolio has exposure to the winners who disrupted these companies (recent examples include Netflix, Amazon, Apple, Tesla, and Nvidia). This natural order of competition, creative destruction, and extreme incentives to win the competition of business exists in the American system regardless of who has power. While certain policies could have meaningful long-term impacts on corporate profitability, history tells us that the American system of checks and balances has generally minimized the benefit or damage that could be caused. Most policies enacted by new presidents have only marginal, and not systemic, impacts on portfolios.

The Federal Reserve

If there’s one institution that has a consistent and profound impact on markets, it’s not the presidency but the Federal Reserve. Monetary policy, especially decisions to raise or lower interest rates, has far more influence on market performance than partisan politics. In recent years, the Federal Reserve has carried out one of the most hawkish sets of monetary policy actions in history. In 2022 alone, the Fed raised short-term interest rates from zero to 5.25%. This led to immediate impacts in stock market pricing (2022 saw a drawdown from peak to trough in the S&P 500 of more than 24%, and a maximum drawdown in the overall U.S. bond market – the Bloomberg Aggregate Index – of more than 18%).

Similarly, the Fed’s extreme-dovish policies in response to the pandemic of 2020, which included reducing short-term bond yields to zero, buying high yield corporate debt, and buying mortgage-backed securities, help mitigate the fallout of a global economic shutdown. The stock market and bond market ended 2020 with positive returns despite the calamity. It should be noted that Washington’s extreme fiscal policy of 2020 and 2021 likely contributed to these returns and ultimately helped fuel the inflation spike in 2021 and 2022.

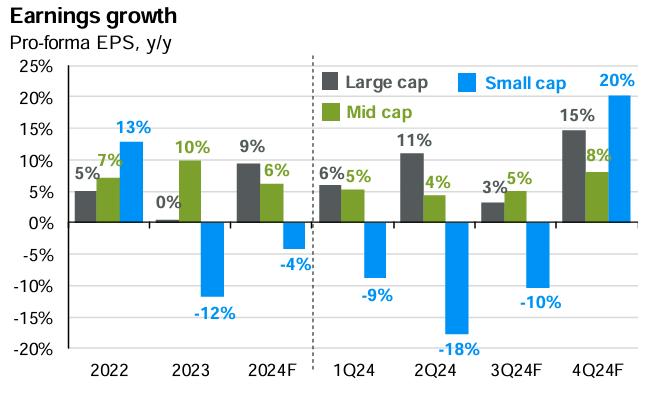

Throughout history, when central banks have eased financial conditions, markets have typically responded favorably. When central banks tighten aggressively, financial markets tend to respond negatively. Yet, with the benefit of time, businesses and market participants learn to live within any environment. Despite the extreme actions of the Federal Reserve in 2022 and the market downturn, corporate profitability has risen dramatically, and smaller companies (that have higher borrowing costs) are finally catching larger companies (that have lower borrowing costs). Ultimately, the competition for profitability will prevail, regardless of the regulatory, monetary, or fiscal policy regime:

Volatility Around Elections

Volatility is common around elections, but it doesn’t last. Historically, volatility tends to peak in late October and early November, coinciding with election uncertainty. However, once a clear winner is announced, volatility tends to subside. Assuming 2024 follows this pattern, we may see a decrease in volatility after the election, regardless of the outcome. Long-term investors understand that these temporary spikes should not derail their financial strategies. So far, the 2024 market has not seen a volatility spike as we approach the election. There was a short and extreme volatility spike in August that was related to an incident with the Japanese Yen, but that has seemingly cooled. Pundits will write the market and volatility narrative after the election plays out, and it’s too early to know if we will continue to see muted volatility throughout this election cycle.

Stay the Course: Stick to Your Plan

With all the uncertainty swirling around the 2024 election, the most prudent investment strategy is simple: build a long-term investment plan and stick with it throughout the political and economic cycles. Whether you support Kamala Harris or Donald Trump, your long-term investment strategy should remain focused on your personal financial goals and the fundamentals of the market—not the political winds of the moment. We encourage you to get out and vote. Vote for the candidate you believe will do the best job for our country. It’s an honor to participate in our electoral process. But when it comes to your investment decision making, let’s keep the politics out of it.

History shows us that markets care about growth and profitability. Both growth and profitability occurred during red and blue administrations. They have also both occurred during divided government. For long-term investors, the bottom line is this: stick to your plan, remain diversified, and avoid making emotional decisions based on the results of the election. The smartest move you can make is to continue to invest based on evidence, not election outcomes.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor. The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. For additional information, please visit: https://verumpartnership.com/disclosures/

Be the First to Know

Sign up for our newsletter to receive a curated round-up of financial news, thoughtful perspectives, and updates.

"*" indicates required fields